- About

- Discover EaseUS

- Reviews & Awards

- License Agreement

- Privacy Policy

- Student Discount

How to Fill Out a Tax Form 5498 [2026 Simple Tutorial]

Melissa Lee updated on Jan 05, 2026 | Home > PDF Knowledge Center | min read

To avoid any error while filling out Form 5498, you must be thoroughly aware of the instructions provided by the IRS. If you are filling out the form for the first time please go through all the information with patience to document the correct details.

In this article, we will discuss all the essential details and a good PDF form filler that will help you to fill out the 5498 form.

Things to Know Before Filling Out a Tax Form 5498

Here are the four things you need to know before filling out this form:

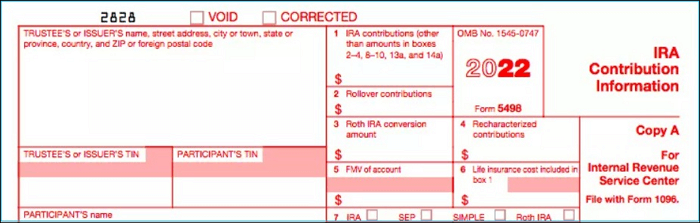

1. What Is a Tax Form 5498?

Form 5498 is the Individual Retirement Arrangements (IRA) and is generally used by financial institutions to file tax return information on behalf of their clients. Using this form, you can deal with the IRA contribution information for that financial year. It also provides information about the other contributions that you have made through a SIMPLE IRA or a Simplified Employee pension.

This form also needs information about contributions, rollovers, conversions, recharacterizations, required minimum distributions (RMDs), and the account's fair market value (FMV). If you have made contributions to an IRA, the financial organization you hired to manage your retirement account need to send you a copy of Form 5498.

2. Who Needs to Fill Out a Tax Form 5498?

Form 5498 helps to list the IRA contributions you've made to the tax year. You must fill out a 5498 tax form if you have an account with a traditional IRA, Roth IRA, SEP IRA, or SIMPLE IRA. The IRS sets contribution limits of around $6,000 to $7,000 for people under age 50 and over 50 years, respectively.

- Notice:

- The contribution limit may change each year.

3. Why Should Users Fill Out a Tax Form 5498?

People fill out Form 5498 for the personal records of their IRA Contribution Information, and the form is not required to prepare the tax return. However, it is essential to provide the information through the 5498 form if they made any distribution from pensions, retirement plans, Annuities, IRAs, insurance contracts, etc.

4. What to Do Before Filling Out This Form?

You should finish your tax return before filling out the 5498 Form, and you can add the distribution information to the form. You will receive the form around the end of May month, which is only for informational purposes.

What is Form 8332 & How to Fill it Electronically

Being custodial parents, you may need this IRS 8332 tax form to release the right to claim for a child as a dependent. After that, the noncustodial parent can claim for the child about the exemption.

How to Fill Out a Tax Form 5498?

If you are planning to calculate your IRA contribution, you can use the various boxes of the 5498 form. It helps to figure out the amount you have contributed to different types of plans. Here is what you need to provide for each section:

IRA Ownership and Type

In the beginning, provide all the basic details, including name, address, account number, and federal identification number about the trustee, and information for the participant, or owner of the IRA.

Box 1. IRA contributions you made in the last tax year and through the current year's tax day.

Boxes 2 and 3. Rollover contribution and Roth IRA conversions amount.

Boxes 4 to 6. Provide the other general information, such as insurance cost, FMV account, etc.

Box 7. Tick the box that identifies your plan type.

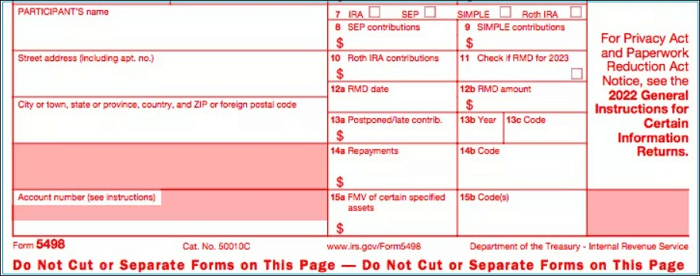

Box 8. SEP-IRAs contributions for the year that includes employer contributions.

Box 9. SIMPLE IRAs contributions for the tax year, and also include employer contributions.

Box 10. The amount you contributed to Roth IRAs in the previous tax year and up until Tax Day in the current year.

Box 11. Check the box to report if you have accepted the required minimum distributions for 2026.

Box 15a. Fair market value of the investments in the IRA.

- Notice:

- The fair market value starts with Roth conversions.

Box 15b. Provide the codes based on the value entered in box 15a. You can enter a maximum of two codes.

Check your claimed value with your tax return to ensure the correct amount you reported on Form 5498. Talk to your plan administrator if you find any issues in the figures.

Bonus Tip: A PDF Editor to Edit the Form

This guide will help you fill out the 5498 form with no hassle. You should double-check all the values for error-free submission. Thus, we would like to share a bonus tip with you to make the process painless. You can use an excellent tool EaseUS PDF Editor to fill and edit your 5498 form or other forms like form 2848.

With this software, you can edit your file and add text box to PDF. It is a powerful PDF editing tool to let you edit, modify, organize and share such PDF forms. You can add or change information and export any PDF to other formats and vice versa. The program has a constructed capacity to make the editing process effortless.

Here are 5 feature of EaseUS PDF Editor:

- Add a signature to PDF document

- Edit, merge, split, rotate your PDF files

- Convert PDF to Word or other file formats

- Digitally sigh your PDF files to protect them

- Scan and OCR a PDF to edit it

The guiding steps are provided below:

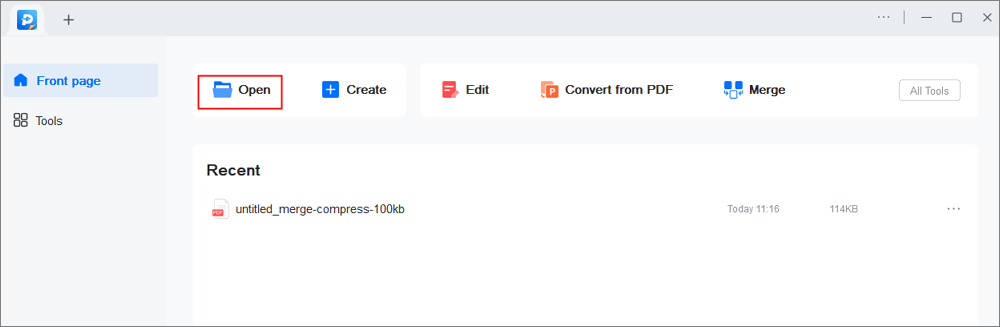

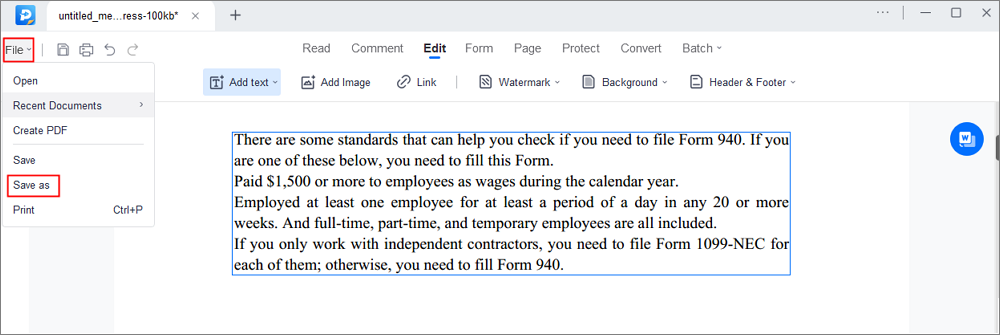

Step 1. Launch EaseUS PDF Editor and click "Open" to import the PDF file you want to edit.

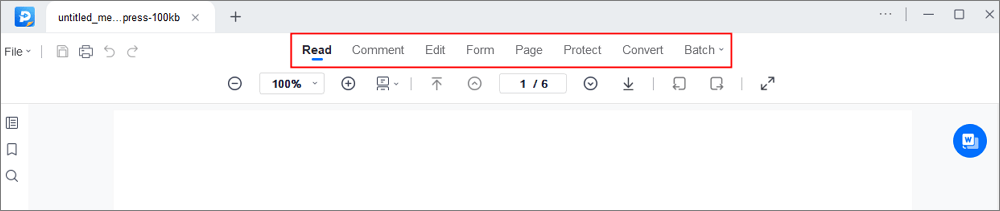

Step 2. When the file is opened, you can see many editing tools, including "Read", "Comment", "Edit", "Form", "Page", "Protect", "Convert", etc. Choose any one you like.

Step 3. After editing, click "File" > "Save as" to save the edited PDF to your computer.

Conclusion

Form 5498 will help you to calculate what you've contributed to different IRAs during the tax year. The form is designed to fill in the necessary information about your tax distribution, and you must document everything correctly. Consult your IRA custodian if you don't get the 5498 form.

You can also use the EaseUS PDF Editor to edit and share the PDF version of this form. You can utilize this program if you want to protect your personal information in PDF form.

FAQs on Tax Form 5498

Having Known how to fill out form 5498, the questions below may be provide more information to you.

1. What is the difference between a 1099 R and a 5498?

Form 1099-R is designed to report your IRA distributions, while you can document your contributions through Form 5498.

2. How do I add form 5498 to TurboTax?

TurboTax does not require entering information from Form 5498 (IRA Contribution Information). You must enter the information in TurboTax that is contained in Form 1099-R.

3. Do I need to report form 5498 on my tax return?

The 5498 Form is designed for informational purposes only. So you are not needed anything for your tax return. However, it helps you to calculate your IRA contribution.

About the Author

Melissa Lee is a sophisticated editor for EaseUS in tech blog writing. She is proficient in writing articles related to screen recording, voice changing, and PDF file editing. She also wrote blogs about data recovery, disk partitioning, and data backup, etc.

![[Form 941 Instruction for 2026] How to Fill Out Form 941](/images/pdf-editor/en/related-articles/24.jpg)