- About

- Discover EaseUS

- Reviews & Awards

- License Agreement

- Privacy Policy

- Student Discount

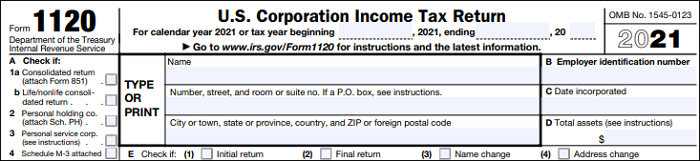

[2026 Updated] What is Form 1120 & How to Fill Form 1120

Melissa Lee updated on Jan 05, 2026 | Home > PDF Knowledge Center | min read

When running your business, there is a must to record the income tax with an IRS form like 1120. The main purpose of this paper is to report income to the IRS. You have a requirement to claim tax deductions and credits. Then, it calculates the tax refund or the tax bill in the financial year. This paper is also a suggestion of your financial situation.

As a businessman, it's your liability to fill out the tax form and handle it to IRS. To associate you with form 1120, this post gives you a full explanation of what it is and how to fill out PDF form with effective PDF editing software.

Related Article>> How to Create a Profit and Loss Statement Template

What is Form 1120

As an IRS tax form, 1120 is used to claim the income and deductions. Then, calculate where you owe the tax or you can use it as a deduction. This is an official tax form from the government, so you don't need to create it yourself. What you need is to download the PDF form from the official website (https://www.irs.gov/forms-pubs/about-form-1120). After that, fill out it.

At the same time, you need to follow the 1120 instructions (https://www.irs.gov/instructions/i1120). This instruction is updated according to the recent punishment from the government. For example, this year, it claims that you can have the COVID-19 related employee retention credit, etc. So, it's important to read this instruction before you fill out the tax form.

What elements this 1120 tax form contains:

- Basic information like name, address, phone number, etc.

- Total income, total deductions, and taxable income

- The amount owed or overpayment

- ......

How to Fill Form 1120

Overall, the tax form tells you how much tax your company needs to pay. You need to fill out the PDF form in order.

Preparation to Fill Out a PDF Form

Before following the below part to fill out the tax form, you need to find the software which supports filling out the form in the PDF file. EaseUS PDF Editor is such an effective tool to help fill out the PDF form. It can fill out the text, number, and tick the box as well. Also, it can help convert the PDF file to other formats like Word, Excel, and PPT.

Download this PDF editing software to fill out the IRS tax form now! No registration is needed.

After downloading the PDF form filler, you need to get the official tax form in PDF and import it to this software. Once finished, follow the below instructions to fill it out. Use the black color for your text.

1. Fill Out the Corporation Information

To know the actual tax you need to pay, fill out the basic information for your business at first, including the business name, number, address, employer identification number, date incorporated, and total assets. Meanwhile, check some items in the box if needed. What's more, don't forget to fill out the recording date on the above side.

2. Calculate the Total Income

In this form, you need to fill out each element (1a-10). Summarize these amounts in 11. The figure in number 11 is an essential figure for calculating taxable income.

Here, you can understand the calculation fully. The formula is (Gross receipts or sales - Return and allowance = Gross receipts from the production of business income). Then, use 1c minus the cost of goods sold to get the gross profit.

After that, use the gross profit to add dividends, interest, gross rents, gross royalties, other income, etc. Or you can understand it as the method to add lines 3 through 10 to get the total income.

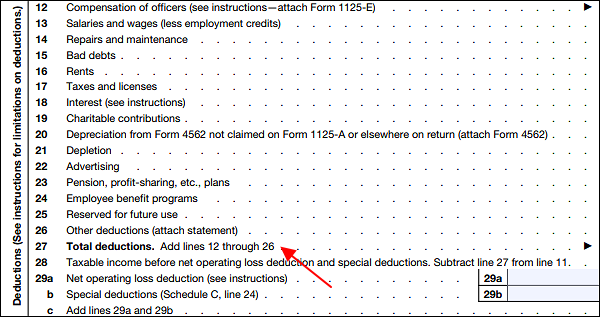

3. Calculate the Total Deductions

Deductions are items that you can avoid paying the tax. Therefore, you are allowed to deduct these items from the total income. However, you cannot deduct whatever you like. What you need is to follow the tax law in your living region. Meanwhile, focus on the recent regulations for tax deductions as the rules could be changed each year.

From the above tax form (IRS form 1120), you need to add lines 12 through 26. Then, you will get the amount in 27 for total deductions. Next, you need to use the total income to minus total deductions. After that, get the taxable income before considering the net operating loss and special deductions.

Finally, add net operating loss deduction and special deduction together. Then, jump into the final step.

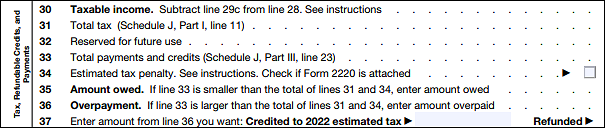

4. Taxable Income

After knowing the total income and total deductions, it's pretty easy to get the taxable income. You need to use line 28 to minus line 29c. Then, know the actual taxable amount for this year you need to pay.

Amount Owed or Overpayment

Before paying the actual amount of tax for your business, you must have paid the quarterly estimated taxes before. Thus, if the estimated taxes are larger than the actual number, it will enter the amount overpaid. Or, it will enter the amount owed.

Conclusion

Believe that you have known what is form 1120 and how to fill out this PDF file. In conclusion, you need to download this tax document from the official website. Then, search for information to calculate the tax deductions. At the same time, don't forget to prepare the PDF form filler like EaseUS PDF Editor.

About the Author

Melissa Lee is a sophisticated editor for EaseUS in tech blog writing. She is proficient in writing articles related to screen recording, voice changing, and PDF file editing. She also wrote blogs about data recovery, disk partitioning, and data backup, etc.

![Print to PDF on Android [Easy Ways in 2026]](/images/pdf-editor/en/related-articles/20.jpg)