- About

- Discover EaseUS

- Reviews & Awards

- License Agreement

- Privacy Policy

- Student Discount

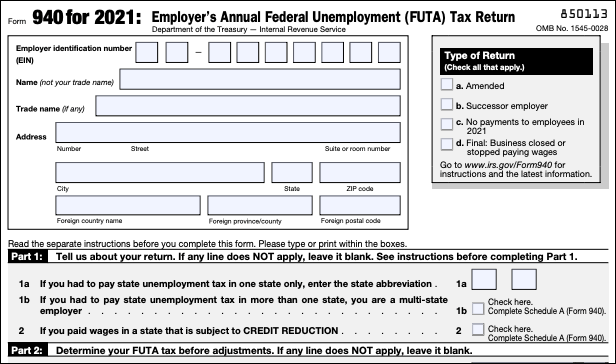

What is 940 Tax Form and How to Fill It

Melissa Lee updated on Jan 05, 2026 | Home > PDF Knowledge Center | min read

Every year, businesses need to fill out tax forms and send them to the authority institute. But some of them lack the knowledge of how to fill out the form correctly and precisely. If you just started a small business and don't know how to tackle the tax form, say Form 940, then you've come to the right place. In this article, we will introduce to you what Form 940 is and show you how to fill it out step-by-step.

What is Form 940?

To put it simply, Form 940 is a document filled with all kinds of information the IRS collects from employers annually. On the form, employers report the wages they paid to all their employees throughout the year. Full-time or part-time, all wages must be reported. Form 940 is different from a similar tax form, Form 941 as Form 941 is the Employer's Quarterly Federal Tax Return. Read ahead, and we will show you how to fill it out easily.

How to Fill out A 1099 Form with a Simple Tutorial in 2026

See the newly updated tutorial on how to fill out a 1099 tax form in 2026!

Do I Have to File Form 940?

Some standards can help you check if you need to file Form 940. If you are one of these below, you need to fill it out.

- Paid $1,500 or more to employees as wages during the calendar year.

- Employed at least one employee for at least some time of a day in any 20 or more weeks. And full-time, part-time, and temporary employees are all included.

- If you only work with independent contractors, you need to file Form 1099-NEC for each of them; otherwise, you need to fill out Form 940.

- Tip

- If you're unsure about whether or not to file Form 940, it's best to talk with a tax professional.

How to Fill out Form 8949 [2026 Guide]

Check this tutorial to see how to fill out form 8949 with an example in 2026!

How to Fill out Form 940

Now that you have a better understanding of what Form 940 is and who needs to file it, you may be wondering how to fill it out correctly. Now, we will walk through the filling process.

Firstly, you must fill out some basic information about your business, including your Employer Identification Number (EIN), business name, trade name (or DBA), and address. After that, you need to fill out the seven parts of Form 940.

Part 1. You need to tell the IRS how many different states you pay unemployment taxes in. If you check the boxes in Line 1b or 2, complete Schedule A of Form 940.

Part 2. In this part, you need to calculate your FUTA tax liability. There are several lines, and they are for different usage. Line 3 will ask you for all payments you made to employees; Line 4 will ask you for any FUTA-exempt payments (like fringe benefits, group-term life insurance, etc.); Lines 6-8 are the places you calculate your total taxable FUTA wages and total FUTA taxes before adjustments.

Part 3. Here you can make adjustments that take into account your state's unemployment tax rules. If all of the FUTA wages you recorded in the previous section were excluded from state unemployment tax, multiply Line 7 by 0.054, record it in Line 9, and go to Part 4.

Part 4. Line 12 will ask you to add Lines 8 + 9 + 10 + 11 to calculate your total FUTA tax after adjustments; Line 13 will ask you for any FUTA payments (or overpayments) you've made so far; Lines 14 and 15 determine whether you have an outstanding balance due (or any overpaid fees).

Part 5. If the amount you calculated in Line 12 is more than $500, use boxes 16a-d to report your FUTA liability for each quarter. You need to make sure that all these add up to what you filled in Line 12.

Part 6. Here you need to designate someone to discuss Form 940 with the IRS on your behalf.

Part 7. Sign your name here after completing the Form.

- Notice:

- On page 3 of the PDF version of Form 940 supplied by the IRS, you will find a payment voucher. This needs to be included with your Form 940. Enter your Employer Identification Number (EIN), total payment amount, business name, and address before submitting it.

A Tool to Help You Fill out Form 940

To fill out the unchangeable From 940 PDF file, you will need a PDF editor. We recommend you to download and use EaseUS PDF Editor. This is a tool designed to convert a PDF file to editable formats or edit the PDF document directly. With EaseUS PDF Editor, you can fill the blanks given in From 940, change the page size of PDF, compress a large PDF file, etc.

After editing, you can even Email it instantly. Moreover, it is quite user-friendly since it is made for novices. In a nutshell, if you have little or no experience in filing a tax Form, this is a steady hand for you. Download EaseUS PDF Editor by clicking the button below.

How to Mail in Your Form

If your FUTA balance is lower than $500, you can mail it. To mail in your form and payment, print both Form 940 and the payment voucher. Mail these, along with your payment, to the address listed for your state.

Conclusion

As you can see, filling out Form 940 is not a difficult task if you have all the guidance above. Not to say that we give you a tool that can make the unchangeable PDF Form editable. Just download EaseUS PDF Editor and start filling out Form 940!

About the Author

Melissa Lee is a sophisticated editor for EaseUS in tech blog writing. She is proficient in writing articles related to screen recording, voice changing, and PDF file editing. She also wrote blogs about data recovery, disk partitioning, and data backup, etc.