- About

- Discover EaseUS

- Reviews & Awards

- License Agreement

- Privacy Policy

- Student Discount

What is Form 8332 & How to Fill it Electronically

Melissa Lee updated on Jan 05, 2026 | Home > PDF Knowledge Center | min read

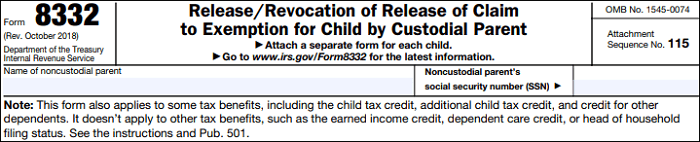

Being custodial parents, you may need this IRS 8332 tax form to release the right to claim for a child as a dependent. After that, the noncustodial parent can claim for the child about the exemption. Also, this form has other purposes like applying some tax benefits, etc. If you need to know about this form and learn how to fill out it, this post is helpful.

- Part 1. Special Considerations Before Filling Form 8332

- Part 2. How to Fill Out Form 8332 Tax Form Electronically

Special Considerations Before Filling Form 8332

Before filling out the IRS form 8332, you need to know more information about it, such as what is used for, who should fill it, etc. After knowing the tax form, you can then start filling out it by following the below guide.

1. What is Form 8332 Tax Form?

Tax form 8332 is used for custodial parents to release of claim to exemption for child in current or future years. Also, it can revoke of release of claim to exemption for child. Like other tax forms, this 8332 form also deals with some tax benefits like the child tax credit, additional tax credit, etc. While it's not used for tax benefits like income credit, etc.

Do you know where to get this tax return form? You can go to the IRS website: https://www.irs.gov/pub/irs-pdf/f8332.pdf. From the location, download this tax form in PDF version and then submit it.

2. What is Form 8332 Used For?

There are two main purposes for this tax return form 8332. First of all, it's for releasing a claim for your child as custodial parent. The reason for this disclaimer is for the noncustodial parent to claim the child's exemption. The noncustodial can then claim the tax credit and additional tax credit after custodial parents finishing the tax form. In this part, you can release a claim for the current year or future years. Secondly, it's to revoke a previous release of claim to the exemption for child.

3. Who Should Fill Form 8332?

This tax form from IRS is used for custodial parents to pass the tax exemption for child to noncustodial parent. Therefore, this 8332 form must be created by custodial parents and then to be attached on tax forms of noncustodial parents.

Also Read>> Who Can Fill out 1040-SR

4. When to Use Form 8332?

This tax document from IRS should be used at the time a divorce or a separate parenting agreement designates that the noncustodial parent is able to claim a dependent child. So you need this form to allow noncustodial parents to claim the child's exemption. When you fill out the form, you can claim the exemption in the current or future years.

How to Fill out A 1099 Form with a Simple Tutorial in 2026

See the newly updated tutorial on how to fill out a 1099 tax form in 2026!

How to Fill Out Form 8332 Tax Form Electronically

Once you have downloaded the PDF form from the IRS website, you can see it has not many lines to be filled. So, only in a few steps can you complete this tax return form. Below is a list of steps on filling out this form 8332.

Step 1. Preparation to Fill out IRS Form 8332

To fill out the IRS tax form 8332 electronically, you need to prepare a all-in-one PDF form filler and signer. One recommended software is EaseUS PDF Editor, the PDF editor on Windows. With it, you can not only fill out 8332 form, but also other forms like W2, W3, W9, 2848, etc. Without registration, you can try this PDF filling software on Windows for free!

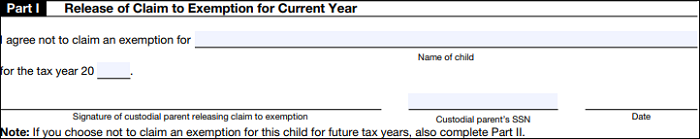

Step 2. Release of Claim to Exemption for Current Year

Complete the first part to release a claim for your child for the exemption in the current year. You need to fill out the name of child, the year of releasing, signature and SSN for the custodial parent, and the date to complete this tax form 8332.

Step 3. Release of Claim to Exemption for Future Years

For custodial parent, you can also use this tax form to release of claim to for child exemption for one or more future year.

For helping make sure future support, you may not need to release exemption claim for child for future years.

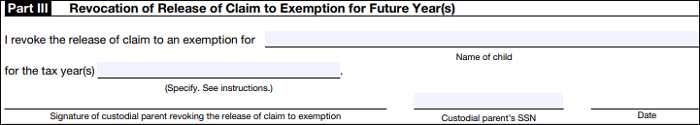

Step 4. Revocation of Release of Claim to Exemption for Future Year(s)

In part three, you are allowed to revoke a previous release of claim to an exemption for your child. Also, you need to notice that the revocation will take effect no earlier than the tax year following the year when offering the copies to non-custodial parent to withdraw or make reasonable efforts to provide revocation copy.

Conclusion

After viewing this post, you may know better about the 8332 tax form from IRS. Its mainly purpose is to release or revoke of release of claim to exemption for child. After filling the form from custodial parent, the noncustodial parent can then claim the dependent child. It's simple to fill out the form as custodial parent as the form only contains a few lines.

To fill out it electronically, you need one PDF form filler. One recommended software is EaseUS PDF Editor, the easy-to-use and efficient PDF editing software on Windows PC. Now, try it for free!

About the Author

Melissa Lee is a sophisticated editor for EaseUS in tech blog writing. She is proficient in writing articles related to screen recording, voice changing, and PDF file editing. She also wrote blogs about data recovery, disk partitioning, and data backup, etc.