- About

- Discover EaseUS

- Reviews & Awards

- License Agreement

- Privacy Policy

- Student Discount

[2026 Ultimate Instruction] How to Fill Out Form 1065 in Minutes

Melissa Lee updated on Jan 05, 2026 | Home > PDF Knowledge Center | min read

Form 1065 is a tax file used by Internal Revenue Service, which is used for reporting the partnership's income, gains, losses, deductions, credits, and other related information. You need to know that the partnership will not pay tax on the income but notice the profits or losses. As it is used for partnership, you can add partnership items or information in this 1065 form.

Here, this post shows what is the form 1065 and the things you need to prepare for this IRS tax form. Meanwhile, you need one PDF form filling software named EaseUS PDF Editor to fill out this form effectively.

- Part 1. Things to Know Before Filling out Form 1065

- Part 2. How to Fill Out Form 1065 - Simple Steps

- FAQs About How to Fill Out Form 1065

Things to Know Before Filling out Form 1065

Before filling out the IRS form 1065, you need to read the following information and know more details about it. Then, start filling out the tax form with details. You can know the information about what is the IRS form, who needs to fill it out, etc.

1. What is the IRS form 1065 for?

Generally, 1065 form is used to report the profits, losses, and deductions for a business partnership for tax consideration. At the same time, IRS form 1065 shows the partnerships' financial status in the year. When the partners fill out the tax form, they can pay the taxes based on the shares. Also, partners need to pay income tax on the earnings amount.

You might want to know how to fill out 4506-T form

2. Who is required to file a form 1065?

Because this form is used to report the income, gains, losses, and other information for partnerships, therefore it is mainly used for domestic business partnerships. What is the partnership? It refers to the relationship between two or more persons who deal with a trade or business together. Also, there are kinds of partnerships like limited partnerships, joint ventures, etc.

For foreign partnerships with income in the U.S, it's necessary to fill out the form if the earning is more than $20,000 in the country (updated in 2018). Also, you need to know that this 1065 form is completed by LLCs (Limited liability corporations) and foreign partnerships with income in the U.S. Meanwhile, the partnerships should submit the Schedule form as well.

Meanwhile, nonprofit organizations should fill out it. It shows that the profits are distributed to holders as dividends.

[2026] Who can File Tax Form 1040-SR & How to Fill it

Learn about who can file tax form 1040-SR & how to fill it in 2026!

3. Where do I enter form 1065?

The place to enter form 1065 depends on the located place of the partnership. You need to go to the website https://www.irs.gov/filing/where-to-file-your-taxes-for-form-1065 for more information.

For example, if the partnership is located in Indiana, and the total assets at the end of the tax year are less than $10 million. You need to submit form 1065 to the department of the Treasury Internal Revenue Service.

4. What other Forms do You Need?

Because this form is used for showing the financial status, you also need other forms as followed.

- Form 4562: Depreciation and Amortization

- Form 1125-A: Cost of Goods Sold

- Form 4797: Sale of Business Property

- Form 1099: Non-employment Income

- Form 8918: Material Advisor Disclosure Statement

5. When do you need to File Form 1065?

The domestic partnership needs to fill out the form 1065 by the 15th of the 3rd month following the date its tax year ended. Also, if you are in the calendar year partnerships, the date is March 15.

How to Fill out A 1099 Form with a Simple Tutorial in 2026

See the newly updated tutorial on how to fill out a 1099 tax form in 2026!

How to Fill Out Form 1065 - Simple Steps

Follow the below steps to learn how to fill out the IRS tax form 1065 effectively.

Preparation to Fill out the Form 1065

One form filler is needed here. You can try EaseUS PDF Editor on Windows. It can create forms in PDF, fill out forms in PDF, sign the forms, and even tick the form. You can modify the forms with uploaded tax forms or in a blank PDF.

Not only editing the forms, but also you can edit the text, images, and other content on the PDF pages. Here, you can download this software without registration. After installing, import the PDF into this software and follow the below guide.

Step 1. Fill out Personal Information in Form 1065

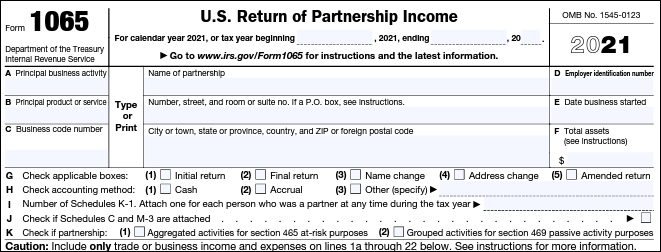

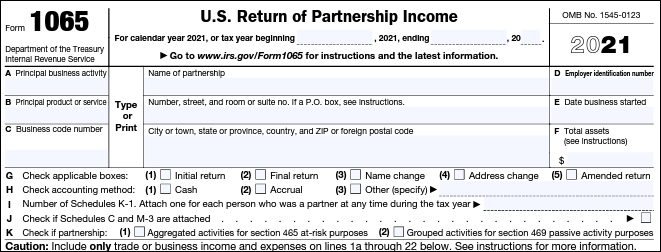

Below is a screenshot of IRS tax form 1065. First of all, fill out the tax beginning and ending year. Then, record the principal business activity, products, and the business code number. Meanwhile, type the name for the partnership. Also, the number, street, city or town, state, and ZIP code should be filled as well.

On the right side of the tax form, you need to fill out the employer identification number, the date that the business started, and total assets. Don't forget to tick the box for checking the applicable boxes, accounting method, and the number of schedules you need to fill. For line K, you can check if "Aggregated activities for section 465 at-risk purpose" or "Grouped activities for section 469 passive activity purposes".

Step 2. Fill out Income, Deduction, and Tax & Payment

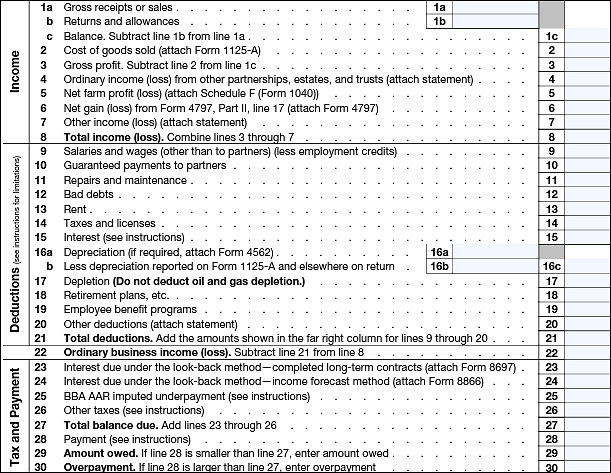

Because this tax form is used to show the partnership's financial status, you need to fill out items for income, deductions, and tax & payment. From line 11 to line 30. Here is the screenshot for this part.

Step 3. Sign 1065 Form with Name

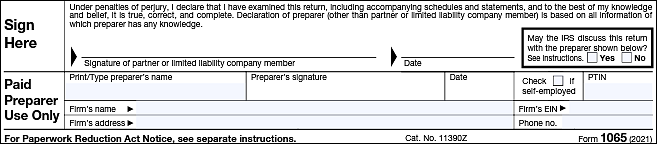

For each tax form, don't forget to sign your name with the date. Also, you need to record the preparer's name, signature, and date. Meanwhile, you should fill out the partnership's name and address in the form.

Step 4. Fill out Schedules Based on Your Needs

Look for information in "https://www.irs.gov/instructions/i1065" to see whether you need to fill out the schedule or not.

FAQs About How to Fill Out Form 1065

Some related issues about filling out the form 1065 gathered from the public are listed here.

1. How do I fill out a partnership tax return?

Step 1. Go to the IRS website and check for the latest instruction for filling out the tax form. It's important to check if you are suitable to fill out the tax return form or not.

Step 2. Then, follow the instruction to complete this tax form easily.

Step 3. In most cases, the tax forms require you to sign with your name and date.

2. What do I do with a form 1065?

Open the official PDF document on the IRS website. Usually, it will open with the Adobe tool automatically. Then, remember to check the instruction to know how to fill out the form and where to hand the tax form.

3. Do I need to file 1065 with no income?

For more information about this IRS tax form 1065, go to the website for 2026 instructions (https://www.irs.gov/instructions/i1065).

4. What is the limited partner?

A limited partner is under a state limited partnership law. The personal liability for partnership debts is limited to the amount of money that the partner contributed or is required to contribute to the partnership.

About the Author

Melissa Lee is a sophisticated editor for EaseUS in tech blog writing. She is proficient in writing articles related to screen recording, voice changing, and PDF file editing. She also wrote blogs about data recovery, disk partitioning, and data backup, etc.

![How to Compress PDF to 2MB [Online & Offline]](/images/pdf-editor/en/related-articles/13.jpg)