- About

- Discover EaseUS

- Reviews & Awards

- License Agreement

- Privacy Policy

- Student Discount

[2026] Who can File Tax Form 1040-SR & How to Fill it

Melissa Lee updated on Jan 05, 2026 | Home > PDF Knowledge Center | min read

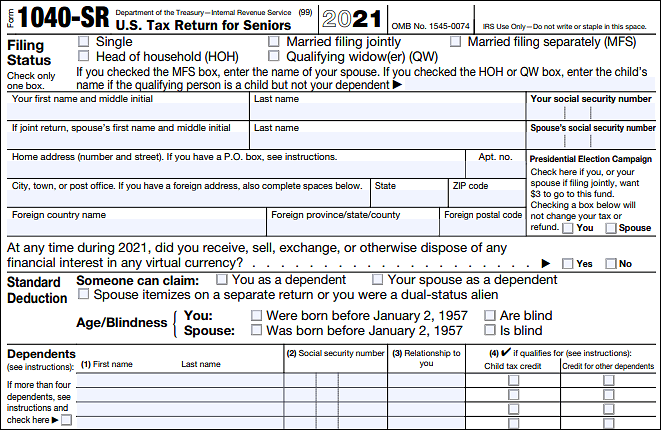

Tax form 1040-SR or U.S. tax return for seniors is designed for those age 65 by the end of 2021. It offers greater tax benefits for seniors, like special deductions. When you download this PDF form, you will notice there is a chart for the additional standard deduction. This post here guides you on who can fill out this form, how to fill out form 1040-SR, etc.

- Part 1. Who can File Form 1040 SR?

- Part 2. Where to Get IRS Form 1040-SR?

- Part 3. How to File IRS Form 1040-SR - 6 Steps

Who can File Form 1040 SR?

As mentioned before, 1040-SR is designed for seniors. If you were born before January 2, 1957, then IRS form 1040-SR is what you need to fill out. In 2021, this form is for those 65 or older. For people who are younger than this age, form 1040 is required. No matter whether you are using form 1040 or form 1040-SR, the schedules are almost the same.

Related Article>> How to Fill Out W9 Form

Where to Get IRS Form 1040-SR?

The very first thing to deal with tax form 1040-SR is to download the file from the IRS website. The form type is in the PDF version. You can find it under the Current Revision tab. Download it and then choose to fill it out by e-filling or writing it by hand. The download location is "https://www.irs.gov/forms-pubs/about-form-1040-sr". Also, when using 1040-SR, you can use IRS schedules like schedules 1, 2, and 3. These schedules can report details that won't show directly on form 1040-SR.

Meanwhile, refer to the Instructions for forms 1040 and 1040-SR in PDF or eBook versions, on the IRS website as well.

How to File IRS Form 1040-SR - 6 Steps

When filling out the tax IRS form 1040-SR, it's essential to understand what information you need to prepare. Likewise, you need to prepare personal information as well as some accounting knowledge to complete the chart.

Items that are Included on IRS Form 1040-SR

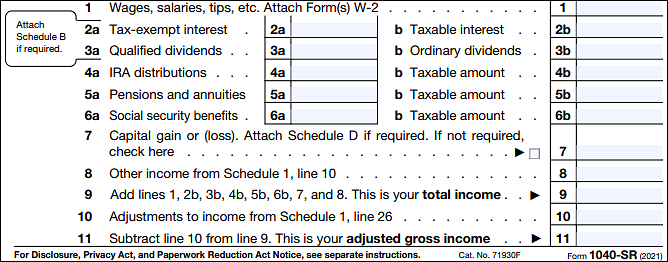

Apart from your personal and basic information, this tax form includes items like wages, salaries, tax-exempt interest, qualifies and dividends, taxable income, earned income credit, etc.

Guide on Filling out IRS Form 1040 SR - (Steps by Steps)

Now, this part shows you how to fill out IRS form 1040-SR digitally.

Step 1. Preparation for PDF Form Filler

Once you have downloaded the PDF form from the official website, don't forget to prepare a beneficial PDF reader filler if you choose to e-filling the file. Here, you can choose PDF filler like Adobe Reader, EaseUS PDF Editor, etc.

Of source, Adobe software may be the most functional PDF filler. However, EaseUS PDF Editor can achieve most functions as Adobe offers. If you want to select affordable and dedicated PDF software, it is a good choice as well.

Now, download this PDF page filler on Windows PC! No registration is needed.

Step 2. Fill out Personal Information in Form 1040-SR

(Before filling, you can import this document into the PDF software)

Now, look at the official tax form and learn how to fill it out clearly. Firstly, it requires your filing status, you and your spouse's name (if have one). Also, home address, state, ZIP code, social security number, and other related information are required as well. And in 2021, the recording of virtual currency like Bitcoin purchases is also be considered.

Next, as this tax form is specified for seniors, you need to record the "Standard Deduction" option as needed.

Step 3. Calculate the Adjusted Gross Income

Before getting the tax figure, you need to know the gross income. In this chart, you need to record income items from line 1 to line 8, including wages, salaries, tips, retirement benefits, etc. Then, join these numbers together and record the total amount in line 9. After that, get the adjustments to income in line 10. You can find it with Schedule 1.

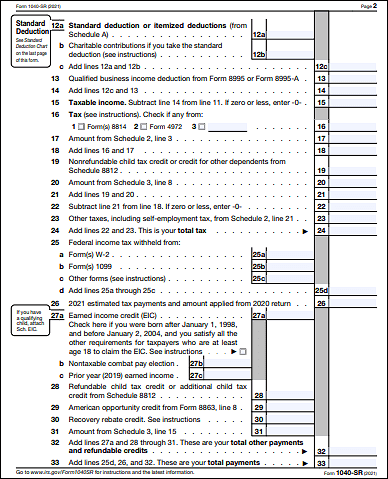

Step 4. Calculate the Total Deductions & Total Tax & Total Payments

The second page contains many figures you need to fill out. Follow the instructions and words to calculate the number. Also, the important thing when filling out the chart is that you need to prepare the true, correct, and complete information.

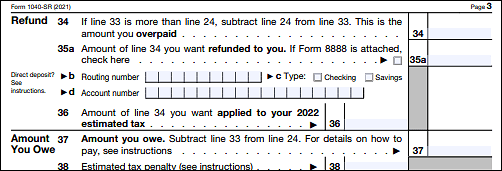

Step 5. Fill out the Refund & Amount You Owe

For amounts that owe, you need to subtract line 33 from line 24. Also, view the instruction to know the estimated tax penalty. These two types are what you need to calculate before signing this chart.

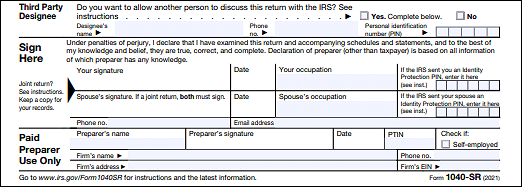

Step 6. Sign this Document

There are several places in this chart to sign the name:

- Third-Party Designee: If you want to allow another person to discuss this return with IRS, show the designee's name, etc.

- Sign Here: Declare that the information you have filled in this chart is true, correct, and complete.

- Paid Preparer: This part is for paid preparer use only.

FAQs About IRS Form 1040 SR

More details are listed here to introduce IRS tax form 1040-SR.

1. What is Form 1040-SR?

Similar to Form 1040, Form 1040-SR is designed for seniors. For people who want to use this chart, it's required that you need to be born before January 2, 1957.

2. What is the difference between Form 1040 and Form 1040-SR?

Actually, the functions of these two forms are the same, and items in these two forms are similar. Also, form 1040-SR users will have almost the same instructions as form 1040 does. However, the obvious difference between form 1040 and form 1040-SR is the users' age. If you are a person who was born before January 2, 1957, it's needed to use form 1040-SR.

No matter choosing Form 1040 or Form 1040-SR, don't forget to prepare a PDF reader and filler like EaseUS PDF Editor.

About the Author

Melissa Lee is a sophisticated editor for EaseUS in tech blog writing. She is proficient in writing articles related to screen recording, voice changing, and PDF file editing. She also wrote blogs about data recovery, disk partitioning, and data backup, etc.

![[Complete Guide] How to Post a PDF to Facebook](/images/pdf-editor/en/related-articles/20.jpg)

![[Guide] Convert EML to PDF on Windows/Mac/Online](/images/pdf-editor/en/related-articles/37.jpg)