- About

- Discover EaseUS

- Reviews & Awards

- License Agreement

- Privacy Policy

- Student Discount

Learn How to Fill Out a 4506 T Form for Tax Return Transcript

Melissa Lee updated on Jan 05, 2026 | Home > PDF Knowledge Center | min read

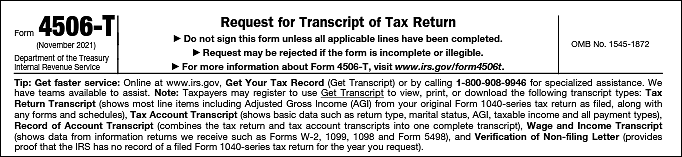

Being a United States Internal Revenue Service tax form, Form 4506-T is created to place transcripts or past tax return data. People need this form when they want to seek a loan to prove their financial status. To fill out this form, you need to prepare your basic and other financial information. Here, this post provides you with detailed steps on how to fill out a 4506 T form and also shows you one PDF filling software on Windows.

Information You Need to Know About Form 4506-T

Before filling out the form, take some time to learn about it. From where to get the form to where to send the form.

Where Can You Get This Form? or How to Get a 4506-T Form Online?

You can obtain the 4506-T form from the IRS website or get this document from your local tax office. Here is the download location: https://www.irs.gov/forms-pubs/about-form-4506-t. It's required to download Form 4506-T in PDF document under the Current Revision. Once downloaded, you can edit the PDF form and then submit it.

How to Fill out A 1099 Form with a Simple Tutorial in 2026

See the newly updated tutorial on how to fill out a 1099 tax form in 2026!

Where to Send Form 4506-T?

Send the filled 4506-T form directly to the IRS at the address. Or you can consider faxing the document (if your religion is allowed). After sending this 4506-T document to IRS, it will mail you a copy document. For the situation that you don't get the copy document within 30 days, please contact IRS to ask for feedback. Check the number from the IRS website. Then, you need to send 4506 pages to Financial Aid & Scholarship Office. They will view the tax form later.

Also Read>> How to Fill out a W4 Form

How to Fill out a 4506 T Form

To fill out the tax return Form 4506-T, you need to read all lines. Also, to make a PDF fillable, you need a PDF filler.

Preparation to Fill out Tax Return Form

You need to prepare one tax form filler such as EaseUS PDF Editor. It can fill the text, number, tick the form, etc. Download this best free PDF editor on Windows. There is no registration needed to try it.

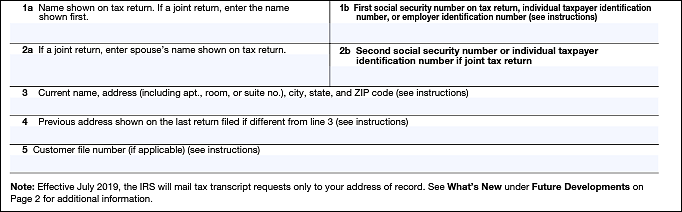

Personal Information Required in Form 4506-T

In 1a, it asks for your basic information like your name or information for a joint return. Next, you need to show your security number in box 1b. Followed, for 2a, it requires your spouse's name if you are in a joint return. The same is for the joint return security number. Now, fill out your latest mailing address, city, state, and ZIP code in box 3. Ensure you leave the complete address as the requested transcript will be sent to the location.

Next, box 4 asks if your previous tax return address is different from your current address. If so, you need to finish this line. Last but not least, you should enter the third party's name and other information if you want to mail the transcript or tax information to a third party.

Transcript Type and Duration of the Tax Return Form

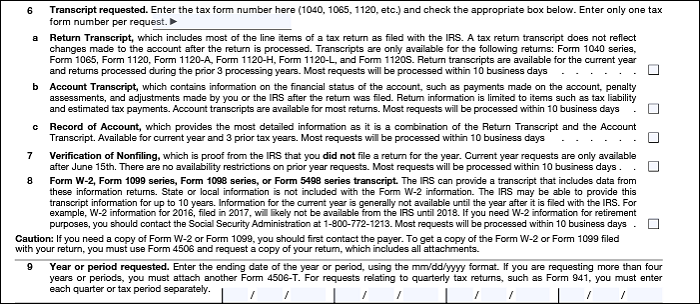

In line 6, it's needed to choose the type of tax return that you need. You can write like a 1040 form, 1065 form, etc. Then, select transcript type to receive. From selection a to c, you can choose the one you require. They are Return Transcript, Account Transcript, and Record of Account.

Meanwhile, for Form 4506-T, you need to know that it is able to request up to 4 years of tax returns. For more years, go to line 9 and require an additional year or period. Like it said, enter the ending date of the year or period. Use the style of mm/dd/yyyy.

Sign and Date Form 4506-T

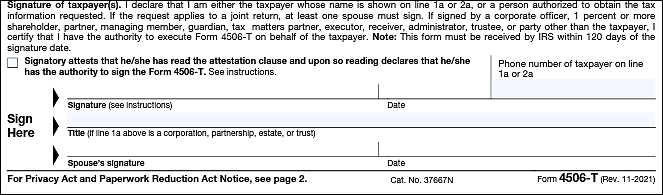

Before submitting to the IRS, please sign and date your name on the bottom side. For a joint return, the other filler should also sign and date the PDF document. Also, you can leave a phone number in the bottom line.

Conclusion

Now, you understand how to fill out a 4506 T form. You need to fill out personal information, choose the transcript type, decide the year of the tax return form, sign the PDF, etc. Also, don't forget to download the PDF form filler, EaseUS PDF Editor. It can not only fill out the PDF form but also create a fillable form in a PDF!

FAQs About How to Fill Out A 4506-T Form

Some related information about this tax return form is listed here.

1. How long does it take IRS to press 4506-T?

After submitting the form to IRS, it usually takes 30 to 60 days to process it. IRS will send you a copy document for the tax return form during the time period.

2. What is the 4506-T form used for SBA?

It is required for your disaster loan application submission. You need to finish this form and mail it to U.S. Small Business Administration (SBA). Check more details on https://www.sba.gov/sites/default/files/articles/f4506-t-2015-09-00.pdf

3. Why is a 4506-T required?

This tax return form allows your lender to verify with the IRS the form you provide to prove that your income is consistent with the income owned by the IRS. If you want to make a loan, then this 4506-T is needed.

About the Author

Melissa Lee is a sophisticated editor for EaseUS in tech blog writing. She is proficient in writing articles related to screen recording, voice changing, and PDF file editing. She also wrote blogs about data recovery, disk partitioning, and data backup, etc.