- About

- Discover EaseUS

- Reviews & Awards

- License Agreement

- Privacy Policy

- Student Discount

How to Fill out Form 8949 [2026 Guide]

Melissa Lee updated on Jan 05, 2026 | Home > PDF Knowledge Center | min read

Some businesses are now required to report all disposals on Form 8949. However, correctly filling out the form isn't an easy task — especially if you've used multiple wallets and exchanges during the tax year.

If you are not sure how to fill out Form 8949, in this guide, we'll share everything you need to know about Form 8949. We'll also give you a step-by-step guide on how to fill it out. By the way, since the form is usually a PDF file, if you want to fill it out, you may need the PDF editor we give you.

Things You Need to Know Before Filling out Form 8949

In this part, we will show you the basic information about Form 8949, including what it is and who needs to fill it out. If you find that you need to fill it, then you can move on to the next part; but if there is no need for you to fill it, you may just quit reading the rest of the article.

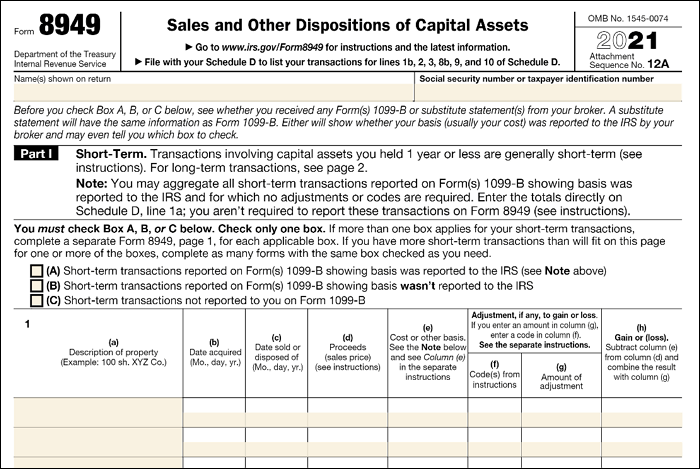

What Is Form 8949?

Tax Form 8949 is used to report the sale of capital assets of your company. Capital assets include stocks, cryptocurrencies, art, rare coins, real estate, etc. Basically, these are all tangible assets.

Who Needs to Fill out This Form?

If you've traded cryptocurrency in the past year, you may receive Form 1099 from one or more cryptocurrency exchanges. Actually, if you have received one or more Forms 1099-B, Forms 1099-S, or other IRS-allowed substitutes for those forms, you need to file a Form 8949.

How to Fill out A 1099 Form with a Simple Tutorial in 2026

See the newly updated tutorial on how to fill out a 1099 tax form in 2026!

How to Fill out From 8949?

There are six steps you need to take in filling out Form 8949. Let's look at them one by one.

Step 1. Take into account all of your disposal events. Every one of your cryptocurrency disposals during the tax year should be counted, with no exceptions. For example, the ones related to selling your cryptocurrency, trading it for another cryptocurrency, or using it to buy other goods or services.

Step 2. Collect information on your cryptocurrency disposals. The following information is needed:

- A description of the property you sold

- The date you originally acquired the property

- The date you sold or disposed of the property

- Proceeds from the sale (market value at time of disposal minus any related fees)

- Your cost basis for purchasing the property

- Your gain or loss relating to the property

Step 3. Divide your transactions into short-term and long-term disposals. Form 8949 is divided into two sections: short-term and long-term. If you held your assets for less than 12 months, they should be reported in the short-term section. If it's more than 12 months, they should be reported in the long-term section. Tax rates for these two situations are different.

Step 4. Select the correct option. In both the short-term and long-term sections, you'll need to select one of three checkboxes. Here are the options in Part I.

A. Short-term transactions reported on Form(s) 1099-B showing basis were reported to the IRS

B. Short-term transactions reported on Form(s) 1099-B showing basis weren't reported to the IRS

C. Short-term transactions not reported to you on Form 1099-B

If you select box C, most cryptocurrency exchanges do not send Form 1099-B to customers. If you've received Form 1099-B from an exchange, you'll need to select box A or box B.

Step 5. Report your disposals on Form 8949. Now, you can get started recording your cryptocurrency disposals on Form 8949.

Step 6. Once you've finished reporting your disposals on Form 8949, you are required to report your net short-term and long-term capital gains/losses on Schedule D.

How to Fill out A 1099-NEC [Latest Guide]

Learn how to fill out a 1099-NEC form with the latest guide!

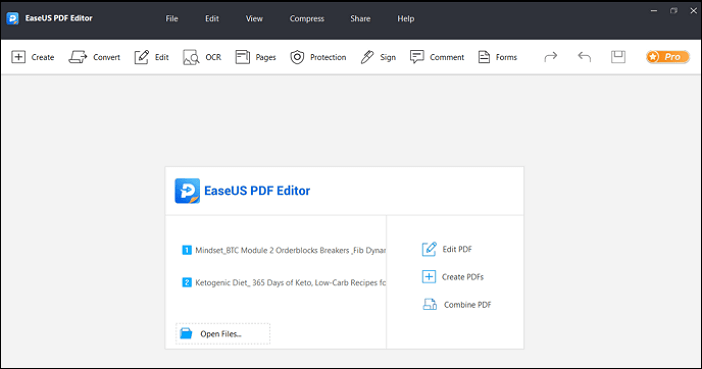

A PDF Editor to Help

The IRS tax forms are usually in PDF form. If you just download it from the official website and want to fill it out on your computer, you may need a PDF editor that can help you convert the file into fillable status. EaseUS PDF Editor is just what you need.

As a PDF editor and converter, EaseUS PDF Editor enables you to fill out tax forms like Form 940, Form W-3, Form 8949, etc. It can also help you E-sign your forms after completing the content. Also, if you are worried about the security of your file, just put a password on it to protect it from leaking.

Main features:

- Add a password or watermark to protect PDF files

- Sign a PDF document on your computer easily

- Add text, images, and shapes to your PDF file

- Convert files of other formats like Docx to PDF

- Create a PDF file from scratch in just one click

Conclusion

As you can see from the article, filling out a tax form is simple if you know what information to fill in which blank. We have shown you how to fill out Form 8949 and have given you a capable PDF editor - EaseUS PDF Editor to edit the form. Just download it and start filling out Form 8949 now!

About the Author

Melissa Lee is a sophisticated editor for EaseUS in tech blog writing. She is proficient in writing articles related to screen recording, voice changing, and PDF file editing. She also wrote blogs about data recovery, disk partitioning, and data backup, etc.

![[2026] Who can File Tax Form 1040-SR & How to Fill it](/images/pdf-editor/en/related-articles/13.jpg)

![4 Ways to Convert PDF to Pages on Mac [2026]](/images/pdf-editor/en/related-articles/27.jpg)