- About

- Discover EaseUS

- Reviews & Awards

- License Agreement

- Privacy Policy

- Student Discount

How to Fill Out Form 8822 - Best Guide in 2026

Melissa Lee updated on Jan 05, 2026 | Home > PDF Knowledge Center | min read

Suppose you are a taxpayer who moved to a new home. In that case, it's important to notify the Internal Service of your change of address, or the IRS will often send you the refund paid with a paper check and other correspondence relating to your personal, gift, and estate taxes to the last known address. And the easiest way to notify the service that you have changed the address is to use IRS Form 8822. If you are new to Form 8822, just stay here to learn more tips about the 8822 form.

- What is Form 8822

- Who Needs to Fill and File Form 8822

- How to Fill Out IRS Form 8822

- Where to Mail Form 8822

- Alternatives To Form 8822

What is Form 8822

Officially called "Change of Address", IRS Form 822 is often used to let the IRS know your new mailing address. If you complete and send the IRS your 8822 change of address, then the service will have the right contact information for you on file, which means you will get the letters, notices, checks, or other mails at your new home address.

Who Needs to Fill and File Form 8822

As we discussed before, it is obvious that people who changed their mailing address need to fill out and file Form 8822, so that they won't miss any letters or emails in the future.

Remember that if the change of address affects the mailing address of children who filed income tax as well, you have to complete a separate Form 8822 for each of them.

How to Fill out A 1099 Form with a Simple Tutorial in 2026

See the newly updated tutorial on how to fill out a 1099 tax form in 2026!

How to Fill Out IRS Form 8822

After having a general idea about Form 8822, let's start filling out the form now. But first, you need to find an easy-to-use PDF form filler. We here highly recommend EaseUS PDF Editor, after trying some other PDF programs.

As its name indicates, it is a PDF editing software that helps you complete almost all PDF-related tasks on your Windows PC. On the main interface, you will see some options, such as "Create", "Convert", "Edit", "OCR", "Protection", and also "Forms". You just need to choose a different tab on the second toolbar for different tasks.

When it comes to filling out IRS Form 8822, you just hit the "Form" button, and then you are able to enter anything you want in that PDF form. This software provides a set of tools to enhance your PDF form, like adding or removing the Push button, Check box, Radio button, List box, Text field, etc. What's more, there are lots of other excellent features:

Edit PDFs in the way you want:

This PDF program allows you to add text, bookmarks, hyperlinks, or change text color and fonts as you like. Plus, you are also able to manage your PDF pages by cutting, splitting, reversing, cropping, and a lot more.

Secure your PDF documents:

If there is some confidential information in your PDF file, you can use EaseUS PDF Editor to add a password for it. Once done, no one can access this PDF document without the right password.

Convert to or from PDFs:

This software supports more than 10 formats, and it lets you convert PDF to Excel, PPT, images, or vice versa without losing any formatting and quality.

Once get this Windows PDF form filler, you can check out the below guides to fill out your Form 8822:

Step 1. Prepare the IRS Form 8822

After installing the PDF software, you need to download the TRS Form 8822 online, then open it with EaseUS PDF Editor to start the filling process.

Then prepare some basic information, including:

- the type of tax return you file

- the old mailing address

- the new mailing address

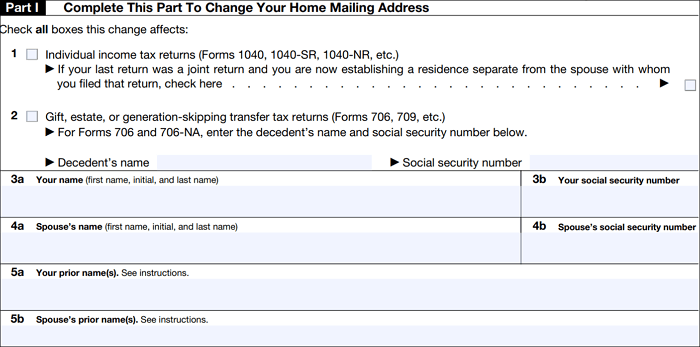

Step 2. Complete Part I

Line 1: You will see two checkboxes here. If the change of address will affect the individual income tasks returns - Form 1040A, 1040NR, etc., check the box on the left. But if your last return was a joint return and you are now establishing a separate residence with your spouse, check the box on the right in Line 1.

Line 2: If the change of address will affect the Gifts or generation-skipping transfer tax returns - Form 706, 709, etc., enter the name and the social security number on the spaces accordingly.

Then enter your families and your information from Line 3a to Line 7, including the names, social security number, spouse's first name, initials, last name, old address, and new address.

While typing the address, keep in mind that you must write the foreign country name, foreign province country, and the foreign postal code in the column if it is a foreign address.

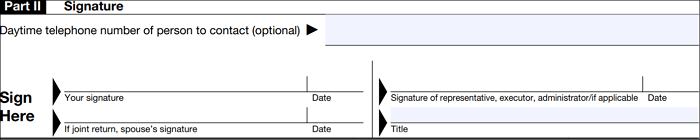

Step 3. Complete Part II - Signature

You need to sign your signature in Part II. As you can see, there is a space where you can sign your signature and write down the data. But before that, you should enter the daytime telephone number of the person to contact, although it is optional.

[2026] Who can File Tax Form 1040-SR & How to Fill it

Learn about who can file tax form 1040-SR & how to fill it in 2026!

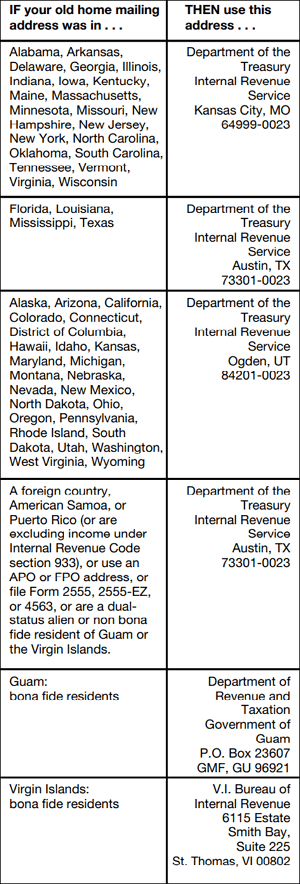

Where to Mail Form 8822

Actually, you can find the answer in the center of the second web page for Form 8822:

- If you checked the box on line 2, you need to send the Form 8822 to the Department of the Treasury, Internal Revenue Service Center, Kansas City, MO 64999-0023

- If you did not check the box on line 2, you could send the Form 8822to the address shown below:

Alternatives To Form 8822

If you are not required to file a tax return, you can try other ways to notify the service of the change of address, instead of filling out and filing Form 8822.

- If you file a tax return and you are planning to file your subsequent one quickly, you can enter the new mailing address directly on the tax return.

- Or, you can write a letter to the IRS including the same information in Form 8822.

If you failed to update your mailing address with the IRS, you might get some penalties if time-sensitive supplies are dispatched to your last identified address.

The Bottom Line

On this page, we provide comprehensive instruction for IRS Form 8822. Whether you want to find out how to fill out Form 8822, file Form 8822, etc., you can always get the correct answer here. As for filling out PDF forms, you cannot miss EaseUS PDF Editor, an all-in-one PDF program that combines viewing, editing, and converting features. In a word, it can help you solve almost any PDF-related task effortlessly.

About the Author

Melissa Lee is a sophisticated editor for EaseUS in tech blog writing. She is proficient in writing articles related to screen recording, voice changing, and PDF file editing. She also wrote blogs about data recovery, disk partitioning, and data backup, etc.