- About

- Discover EaseUS

- Reviews & Awards

- License Agreement

- Privacy Policy

- Student Discount

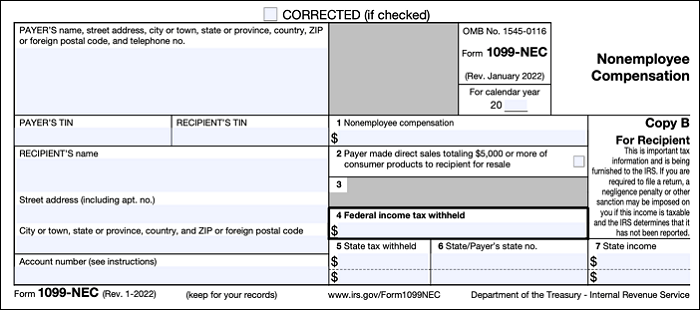

[Tutorial] How to Fill out A 1099-NEC with the Latest Guide

Melissa Lee updated on Sep 19, 2025 | Home > PDF Knowledge Center | min read

Businesses used to fill Form 1099-MISC to report nonemployee compensation and a number of miscellaneous payments to vendors. But if you need to fill out 1099-NEC, you may need this tutorial. If you have paid any non-employees, including independent contractors, freelancers, or others, you must report the total of these payments for the year on IRS Form 1099-NEC. And this article will show you how to do so step by step.

What is Form 1099-Nec?

Form 1099-NEC is used solely to report nonemployee compensation payments of $600 or more you make in the course of your business to individuals who aren't employees; If you make oil and gas payments for a working interest of $10 or more, you need to report the payment on Form 1099-NEC.

How to Fill out 1099-NEC

There are 14 items you need to fill out. They are:

1. Basic information

- Name

- Street address

- City or town

- State or province

- Country

- ZIP or foreign postal code

- Telephone number

All the information above should be filled in the first box.

2. Payer's TIN

Here you need to enter your taxpayer identification number (TIN). Social Security Numbers and Employer Identification Numbers (EIN) are both TINs. The formatting varies depending on whether you use an EIN or SSN:

- Social Security number: XXX-XX-XXXX

- Employer Identification Number: XX-XXXXXXX

3. Recipient's TIN

Next, you need to enter the contractor's TIN. When you hire contractors, they must fill out Form W-9. You can find their TIN there.

4. Recipient's name

The only thing you need to enter in this box is the contractor's name. You can also find it from the Form W-9 you collected.

5. Street address

Enter the contractor's street address. You should be able to pull this information from Form W-9.

6. City, state, country, and ZIP

Enter the following contractor information in this box:

- City or town

- State or province

- Country

- ZIP or foreign postal code

Again, you should be able to find this information in Form W-9.

7. Account number

If you gave the contractor a unique number for your records, enter the account number in this box. Otherwise, leave the box blank.

8. Box 1: Nonemployee compensation

Box 1 is where you enter the total amount of payments you gave to a nonemployee during the year.

Report all the payments that you made, including:

- To someone who is not your employee

- For services in the course of your trade or business

- To an individual, partnership, estate, etc.

- To someone of over $600 during the year

Note: If any payment is not subject to self-employment tax and not reportable anywhere else on Form 1099-NEC, report the amount in Box 3 of Form 1099-MISC.

9. Box 2: Direct sales

If you made any direct sales of $5,000 or more of consumer products for resale, buy-sell, deposit-commission, or any other basis, enter an “X” in the checkbox.

10. Box 3: (Empty)

Currently, Box 3 is empty. You may need to use this box in future tax years, but not yet.

11. Box 4: Federal income tax withheld

If your contractors' wages are subject to backup withholding, you must withhold federal income tax. Just report the amount in Box 4.

12. Box 5: State tax withheld

If you withheld state income tax on contractor payments, report the withheld taxes on Box 5. You can report withheld payments for up to two states.

13. Box 6: State/Payer's state number

If you withheld state tax, enter the abbreviated name of the state, as well as your state identification number, in Box 6; If you are reporting for more than two states, correctly match up the state and amounts, so they are next to one another.

14. Box 7: State income

Last but not least, enter the amount of the state payment in Box 7.

A PDF Editor Help You Fill out 1099-NEC

EaseUS PDF Editor is a PDF editor on Windows which can help you fill a form in PDF format easily and quickly. It lets you deal with any PDF forms within minutes. It is a comprehensive yet easy-to-use PDF toolkit that can edit, convert, combine, split, encrypt, sign a PDF, or add watermark, password, images, pages, and add text to a PDF file easily. Look at its main features below.

Key features:

- Create a PDF by converting from other formats

- Split, rotate, merge, or resize PDF pages easily

- Add passwords to protect your PDF files

- The OCR feature makes your scanned PDF editable

- Fill out other tax forms like Form 940

Download EaseUS PDF Editor from the button below.

Conclusion

Form 1099-NEC is a new form issued by the IRS beginning with the tax year 2020. This article wasn't giving you tax or legal advice, but some clarifications to the Form content. By the way, if you need a PDF editor to edit the file, EaseUS PDF Editor may be your best choice. Just download it on your computer and edit the Form right now!

About the Author

Melissa Lee is a sophisticated editor for EaseUS in tech blog writing. She is proficient in writing articles related to screen recording, voice changing, and PDF file editing. She also wrote blogs about data recovery, disk partitioning, and data backup, etc.

![[Form 941 Instruction for 2025] How to Fill Out Form 941](/images/pdf-editor/en/related-articles/25.jpg)

![How to Fill Out Form I 983 [Simple Tutorial in 2025]](/images/pdf-editor/en/related-articles/8.jpg)