- About

- Discover EaseUS

- Reviews & Awards

- License Agreement

- Privacy Policy

- Student Discount

Instruction to Fill Out Form 8300 PDF Document Easily in 2026

Melissa Lee updated on Jan 05, 2026 | Home > PDF Knowledge Center | min read

Businesses of different types, especially those dealing with product generation and sales, must deal with major transactions. For larger transactions, special forms are important due to government tax regulations. The form 8300 PDF is vital for that to show the validity of the high transaction amount to the FinCEN and IRS.

However, filling a PDF form is not an easy task only if you have the right PDF form filler. This post details more on the form and the tips related to producing it accurately.

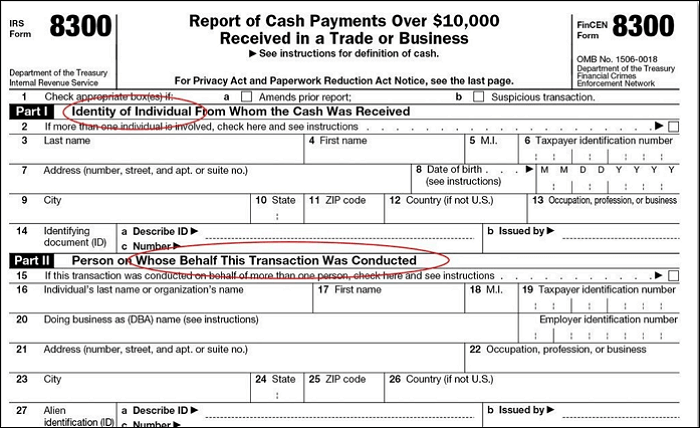

What Is 8300 Form PDF?

The 8300 form PDF is a financial documentation form for reporting major cash payments of USD 10,000 that the recipient got from someone associated with a business or trade. This transaction is possible via multiple payments or a single transaction.

Plus, the authorities that require this notification are the FinCEN (Financial Crime Enforcement Network) and IRS (Internal Revenue Service).

Some of the types of transactions that this form accounts for include:

- Real estate property sale

- Contributions to an escrow arrangement

- Loan repayment

- Purchases of a negotiable instrument

- Available debt payments

- Expense reimbursement

- Services/goods sale amount

- Intangible property sale

- Contributions to a custodial trust

The legal authorities for financial transactions and taxes use this information and verification of anti-money laundering. Therefore, with an 8300 form PDF, you will leave an audit trail for legal authorities to show that your big trade transactions are legal.

Governments typically use this information to investigate criminal activities, unlawful organizational financing, and tax evasion.

Payments that Businesses Should Report via form 8300

Businesses, trades, and individual entrepreneurs should fill out an IRS form 8300 PDF in the following cases:

- The cash amount is USD 10,000 or higher.

- The recipient organization is a business or trade and gets the amount for a professional transaction.

- The business enterprise receives the amount of cash in the way of one full payment of US 10,000 or more.

- A payment that was previously not reported made the total received cash over a 1 year over USD 10,000.

- Partial payments in installments, which cause the whole payment to total over USD 10,000.

- One buyer or agent provides the full cash amount.

- In the case of multiple payments, the recipient gets the money for the same transaction.

The following cash types do not count here:

- A traveler's check, bank draft, cashier's check, or money order with over USD 10,000 face value.

- Personal account checks of the form writer.

To note, if a customer uses over USD 10,000 of cash amount for any financial institution that offers a traveler's check, bank draft, money order, or cashier's check of a monetary instrument, they have to report it with FinCEN CTR.

Who is this applicable to?

Companies engaged in business or trade work, including sole proprietorships, within the United States territories are liable to fill up the 8300 form PDF with IRS for over USD 10,000 cash transactions. The applicable territories here are Guam, the Northern Mariana Islands, American Samoa, U.S. Virgin Islands, and Puerto Rico.

The businesses must fill out the form aside from other taxes that fall under the territory tax rules, like the United States' "territorial mirror income tax code", for example.

How to Fill Out 8300 Form PDF?

Requirements for filing form 8300 are:

- The business filing for a Form 8300 PDF should have their location in one of the approved United territories.

- The recipient filing the form has to inform the customer about this report before filing.

- Any sized businesses, including sole proprietor-run companies, have to fill out the form for transactions at and over USD 10,000.

- The company received an additional amount from the buyer in cash payments within a year on one overall transaction have to fill out a second 8300 form.

- The types of businesses that are liable to fill for this report with FinCEN or IRS only.

- The transactions can include those from casinos with a total annual gaming gross revenue of up to USD 1 million. Non-gaming enterprises include gift shops, hotels, conference/seminar centers, banquet halls/caterers, etc.

- The user has to fill out the IRS 8300 form PDF via BSA E-Filing System or sends the physical form to IRS by mail.

2026 | How to Fill out a PDF Form on Mac

PDF forms are famous worldwide because of their excellent compatibility and sharing properties.

How to fill out an 8300 form PDF online?

People can fill out the form in paper copy and mail the document to the Internal Revenue Service (IRS) headquarters in Detroit. The mail should have certification for authenticity check.

The following are the steps related to filing the 8300 form PDF with IRS/FinCEN.

Step 1: Go to the official website of the Internal Revenue Service. Type 8300 into the Search bar.

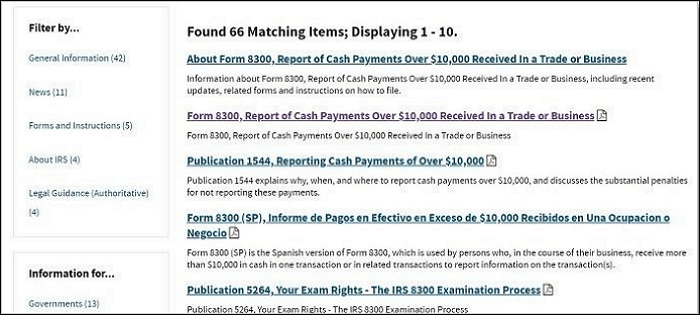

Step 2: From the search results list, click on the link for the 8300 form PDF.

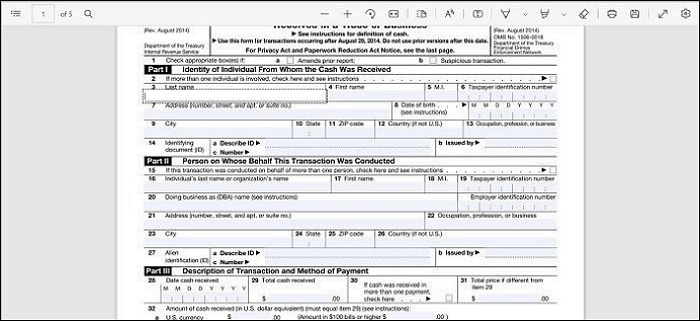

Step 3: When it opens, click the text fields to fill out the information.

Step 4: In Part 1, check the boxes for situations related to your case, like if multiple individuals are involved in the transaction. Add all details as per Part 1 to Part 4 and the sections for additional parties.

Step 5: Save the file and download it. Later, you can add the signature physically or use software like EaseUS PDF Editor to insert it digitally.

Bonus Tip: The Best PDF Editor on Windows

After completing the IRS 8300 form PDF, the information on the digital document is typically hard to alter. If you have to make some corrections or add information to the file, using EaseUS PDF Editor is a suitable choice.

It is a free PDF editor for Windows and allows users to easily edit and convert PDF files like the 8300 form, changing font, images, indentation, etc. Plus, it is simple to use for most people, including those without technical knowledge of PDF file formatting.

Features:

- Add multiple signatures to PDF

- Adjust the text on PDF like size, color, formatting, placement, etc.

- OCR support is available

- Rotate, merge, and split the PDF files

- Password protect PDF files

Benefits:

- Easy to share edited files via email

- Crop or delete sections

- Compress, search, or convert PDF to Word and other file formats

Here are the steps you can follow to use this nice program.

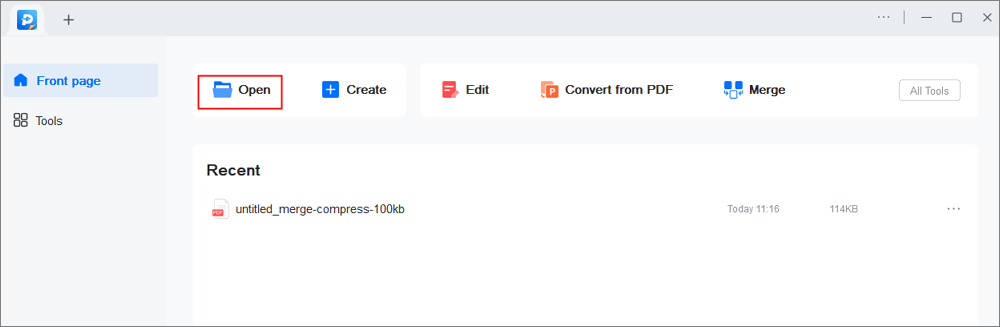

Step 1. Launch EaseUS PDF Editor and click "Open" to import the PDF file you want to edit.

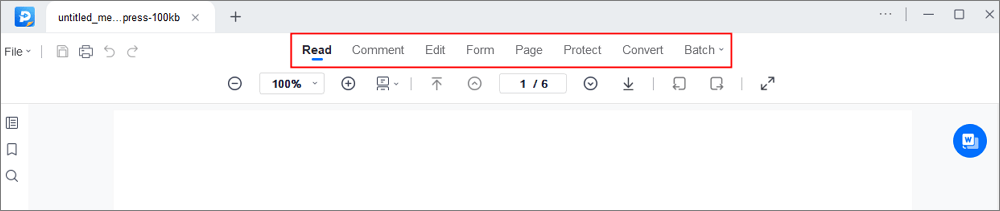

Step 2. When the file is opened, you can see many editing tools, including "Read", "Comment", "Edit", "Form", "Page", "Protect", "Convert", etc. Choose any one you like.

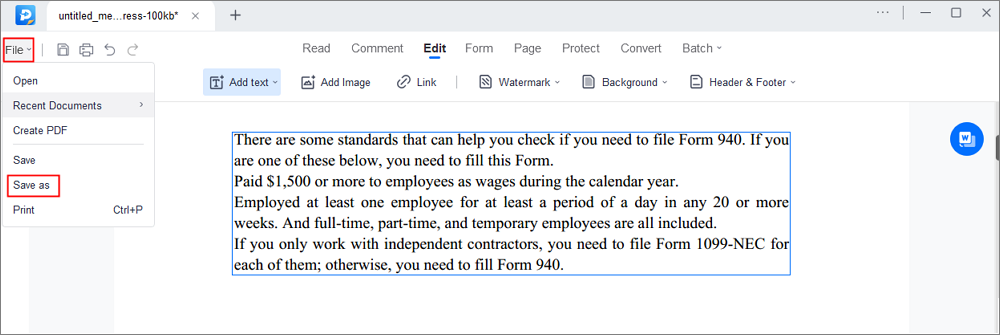

Step 3. After editing, click "File" > "Save as" to save the edited PDF to your computer.

With this great tool, users can fill out a PDF form without too much time and effort. Don't wait, try it right now.

Bottom Line

The 8300 form PDF is very important to show the legal transactional proof upon receiving USD 10,000 or higher from a business or trade entity. Specific types of cash transactions are applied in single or multiple payments, and you can get it from the official IRS site.

Complete the form and then use EaseUS PDF Editor to make important edits, like adding an e-signature before final filing.

FAQs

1. Who Signs Form 8300?

Companies, including sole proprietorships in the United States, have to sign the 8300 form when they receive a cash amount of more than USD 10,000. IRS and FinCEN check this report.

2. How Long Do You Have to Fill Out the 8300 Form?

It is important to fill out the 8300 form within the first 15 days from the time of payment receiving of over USD 10,000. If the date is a legal holiday or falls on the weekend, one must fill it out on the upcoming business day.

3. How Do I Avoid IRS Form 8300?

Businesses can avoid the IRS Form 8300 if the transaction is with another business entity outside the territories of the United States. Plus, financial institutions do not have to fill out the 8300 form either. The CTR or Currency Transaction Report applies to them.

About the Author

Melissa Lee is a sophisticated editor for EaseUS in tech blog writing. She is proficient in writing articles related to screen recording, voice changing, and PDF file editing. She also wrote blogs about data recovery, disk partitioning, and data backup, etc.

![[Form 941 Instruction for 2026] How to Fill Out Form 941](/images/pdf-editor/en/related-articles/32.jpg)