- About

- Discover EaseUS

- Reviews & Awards

- License Agreement

- Privacy Policy

- Student Discount

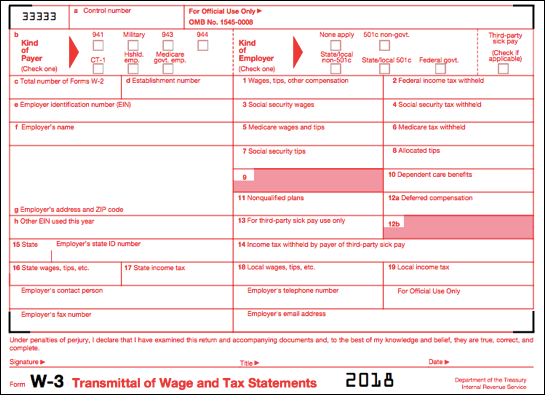

What is a W3 Tax Form and How to Fill It - 2026

Melissa Lee updated on Jan 05, 2026 | Home > PDF Knowledge Center | min read

Once a new company hires its employee, it needs to prepare for tax form filling. However, the skill of filling IRS tax forms doesn't come naturally to many small business owners. And that's why we write this guide to simplify and explain the blanks on the tax form W3. In this article, you will see what the W3 tax form is and how to fill it easily and correctly.

What is Tax Form W3?

Tax form W3, officially the Transmittal of Wage and Tax Statements, is used to add up all parts of Form W2. These two forms are filed together to SSA every year. But what employers need to know is that you need to review all W2 forms for your staff and summarize their wages and tax information, and combine that data into one W3 form to send it to SSA.

Form W3 includes:

- Total income and salary paid to all employees by an employer

- The total portion of that payroll that's subject to Social Security and Medicare (FICA) taxes

- The total tax (both income and FICA) withheld from that pay

Who Needs to File Form W3?

Form W3 is for employers to fill, and in most cases, it should be sent with W2 by January 31st of every year. If you are an employer, and you are required to file Form W2, then you must also file Form W3. And you need to be sure to use the correct version, or you won't fulfill your duty correctly. For instance, you should use the 2021 version for reporting 2021 taxes, even though you may be working in 2026.

How to Fill out A 1099 Form with a Simple Tutorial in 2026

See the newly updated tutorial on how to fill out a 1099 tax form in 2026!

How to Fill out Form W3 Correctly

To fill out tax form W3, you need to prepare some information beforehand, and follow the guide to complete the filling.

What You Need to Prepare

In order to fill out Form W3, you need to have the information below at the ready:

- Your business details:: including your federal employer identification number (FEIN), legal address, and contact information of your company.

- Total wages: including the salary, tips, commission, etc.) you paid to your employees over the prior year.

- Total taxable wages: for Social Security and Medicare.

- Total income tax withheld: both federal and state.

- Total Social Security tax withheld

- Total Medicare tax withheld

Start Filling Form W3

If you have prepared all the information above, you may follow the guide below to fill out the form. Let's fill the boxes one by one:

a: Control Number

b: Kind of payer / Kind of Employer / Third-party sick pay(if applicable)

c: Total number of W2 Forms

d: Establishment Number

e: Employer Identification Number

f: Employer's name

g: Employer's address and ZIP code

h: Other EIN used of the year you are filling data for, including:

1: Wages, tips, and other compensation given to employees

2: Federal income tax withheld

3: Social Security wages

4: Social Security tax withheld

5: Medicare wages and tips

6: Medicare tax withheld

7: Social Security tips

8: Allocated tips

9: (Leave it blank)

10: Dependent care benefits

11: Nonqualified plans

12a. Deferred compensation

12b. (Leave it blank)

13: Income tax withheld by the payer of third-party sick pay

14: State and the employer's state ID number

15: State wages, tips, etc.

16: State income tax

17: Local wages, tips, etc.

18: Local income tax

Employer's contact person/telephone number/fax number/Email address

How to Fill out A 1099-NEC [Latest Guide]

Learn how to fill out a 1099-NEC form with the latest guide!

A Tool That Can Help You Fill Form W3

As the W3 form is a PDF file that can't be edited usually, you may need a tool to make it editable first. EaseUS PDF Editor is just the software you need. With this tool, you can edit the blanks on the W3 form. Or, you can convert it to an editable Word file format first, fill in all the information, and export the file as a PDF again. Of course, you can change the printing settings with it before printing the W3 form out and sending it away. See some of its main features below and you may download it to help you fill out the W3 tax form.

Main features of EaseUS PDF Editor:

- Fill out other PDF forms like form 2848

- Change PDF size, split, combine PDF files

- Customize printing settings as you want

- Send tax forms by Email

Download EaseUS PDF Editor by clicking the button below.

How do I File My W3?

You can file W3 forms electronically. To do so, you need to follow the steps below:

Step 1. Register for the Social Security Administration's business services online (BSO) platform.

Step 2. Log in to your account, use fill-in forms to create W2 forms for each of your employees, or upload wage files from your payroll or tax software.

Step 3. BSO will then generate a W3 for you once you've submitted all of your W2 forms.

Conclusion

In this article, we have shown you how to fill out a W3 form and how to submit it. Also, we give you the user-friendly PDF editor, EaseUS PDF Editor, to help you fill it successfully. Just download it and start filling out a W3 tax form.

About the Author

Melissa Lee is a sophisticated editor for EaseUS in tech blog writing. She is proficient in writing articles related to screen recording, voice changing, and PDF file editing. She also wrote blogs about data recovery, disk partitioning, and data backup, etc.

![How to Fill Out Form I 983 [Simple Tutorial in 2026]](/images/pdf-editor/en/related-articles/38.jpg)

![[Fixed] How to Save Outlook Email as PDF in 3 Simple Ways](/images/pdf-editor/en/related-articles/27.jpg)