- About

- Discover EaseUS

- Reviews & Awards

- License Agreement

- Privacy Policy

- Student Discount

Form 9465 Instruction: How to Fill Out IRS 9465 Form

Melissa Lee updated on Jan 05, 2026 | Home > PDF Knowledge Center | min read

Have you ever finished your tax return only to discover that the refund you anticipated was actually a tax bill? If you meet similar situations and cannot pay the tax in full, you can request an installment agreement to make monthly tax payments. And at that time, you need to fill out Form 9465.

If you are new to the 9465 form, you may get lost in completing the Form 9465. Don't fret, this post is gonna help you. Here we will clarify what form 9465 is, who needs to fill it, how to fill out form 9465, and many more. Just scroll down to learn more information.

You may want to know PDF form filler

What is Form 9465?

Form 9465 is a collections form, and it is only helpful if you owe back taxes to the IRS. If you get the IRS's permission, you can pay the tax monthly instead of a large, one-time lump sum.

Usually, Form 9465 needs to be filled within 120 days after the due date for the payment, and the IRS will respond your request within 30 days.

Who Needs a Form 9465?

Every year, a lot of Americans file their tax returns and find that they owe more income tax than they can afford to pay at one time. If you are one of them, you can ask for an installment agreement to pay it monthly.

So, it is clear that people who cannot pay the total amount of the debt might need Form 9465. However, there are also some limitations to using the Form 9465:

- If you owe $50000 or less, you cannot avoid filling out Form 9465 and completing an online payment agreement application instead.

- If you own a business, you don't need to use form 9465. Instead, you need to fill out form 433-D.

To conclude, if you have a tax debt of more than $50000 and don't own a business, you need form 9465 to request the installment agreement collections form.

How to Fill out A 1099 Form with a Simple Tutorial in 2026

See the newly updated tutorial on how to fill out a 1099 tax form in 2026!

How to Fill Out Form 9465

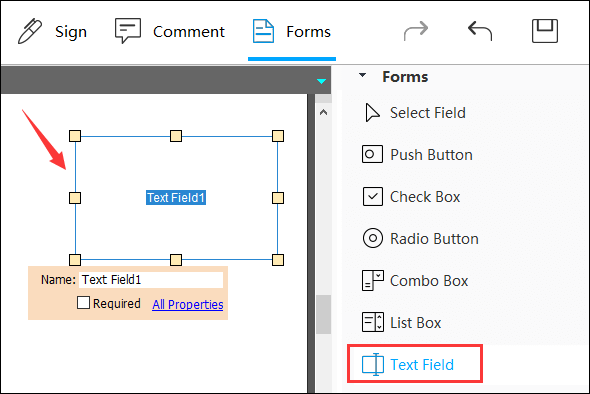

Having known some background information, you can start filling out the IRS Form 9465 by checking the below step-by-step guide. But first of all, you need to prepare an excellent PDF form filler - EaseUS PDF Editor.

With this tool, you can easily deal with all PDF forms, like filling out the blank box, creating checkboxes, and even adding or removing text fields. Besides, you can sign a signature once you complete the PDF forms. Apart from being a PDF form filler, this software also performs perfectly in PDF editing and converting. It provides a variety of tools to modify your PDF documents like adding page numbers, creating PDF bookmarks, changing text color, or even adding watermarks.

As for converting features, it lets you change your PDF file to other formats like Word, Excel, and images while keeping the original formatting and quality. Al in all, whether you want to fill out a PDF form or edit a PDF document, you can opt for this program to simplify your work.

Here is how to fill out the Form 9465 with EaseUS PDF Editor:

Step 1. Prepare a PDF Form Filler

Download EaseUS PDF Editor, and open Form 9465 with it.

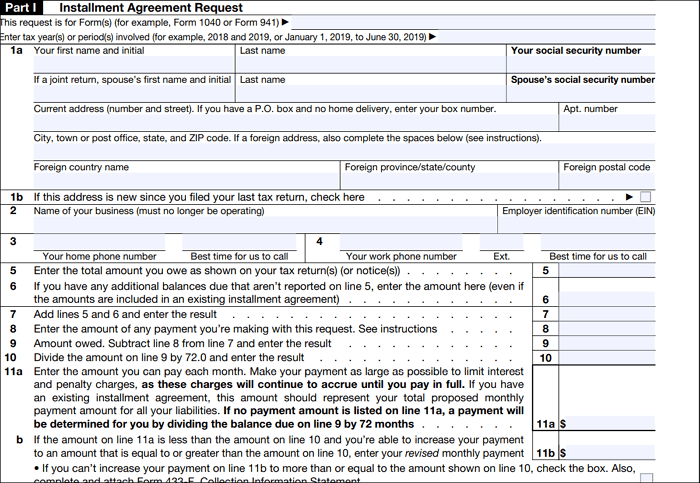

Step 2. Complete Form 9465 Part I - Installment Agreement Request

In Part I, you need to type some basic information, including your address, the name of your financial institution, your employer's name, etc.

Enter your basic contact information in Line 1a. If you are making this request as part of a joint tax return, you need to enter the names and social security numbers in the same order as you did on your tax return. Next, type the employer identification number and your business name in Line 2.

Then you need to fill out how much you owe, how much you are paying right now, and also how much you can afford to pay per month.

At the bottom of Part I, you can set up automatic payments. To make it, you should prepare your bank routing and account numbers.

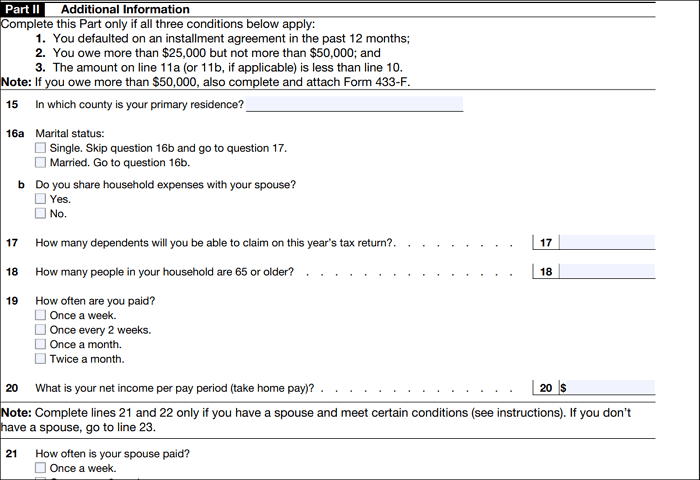

Step 3. Fill Out Part II of Form 9465 - Additional Information

Usually, you don't need to complete the Part II, unless you are in the below situation:

- Have defaulted on an installment agreement within the last 12 months

- The amount you owe is more than &25000 but less than $50000

- The amount on Line 11a is less than Line 10

Step 4. File The Form 9465

Once done, you need to file Form 9465. If you fill out the form online, you can complete the form as part of your online tax return. If you use the paper version, you need to attach the form to the front of your return, and then send it o the address shown on the tax return booklet.

The Bottom Line

Whether you want to learn basic information about Form 9465 or know how to fill out the 9465 Form, you can always count on this post. Moreover, we also share with you an excellent PDF form filler to assist you in completing PDF forms without hassle.

About the Author

Melissa Lee is a sophisticated editor for EaseUS in tech blog writing. She is proficient in writing articles related to screen recording, voice changing, and PDF file editing. She also wrote blogs about data recovery, disk partitioning, and data backup, etc.