- About

- Discover EaseUS

- Reviews & Awards

- License Agreement

- Privacy Policy

- Student Discount

How to Fill out Form 720: Best Guide to Reporting Excise Tax

Melissa Lee updated on Jan 05, 2026 | Home > PDF Knowledge Center | min read

If you have a small business and need to report the excise taxes on a tanning bed, sport finishing equipment, or fuel, you might have to fill out Form 720 quarterly. It seems a little easier for people who often deal with it. However, if you are new to Form 720, you'd better find some instructions before filling and filing, to avoid some mistakes. Here, this post covers almost all related information about IRS Form 720 you may want to know, just continue reading to find the items you are interested in. Moreover, you will find an excellent PDF form filler on thi page - EaseUS PDF Editor.

- What is Form 720

- Who Needs to Fill Out and File Form 720

- How to Fill Out Form 720 with A Step-by-Step Guide

- Best PDF Form Filler for Windows - EaseUS PDF Editor

What is Form 720

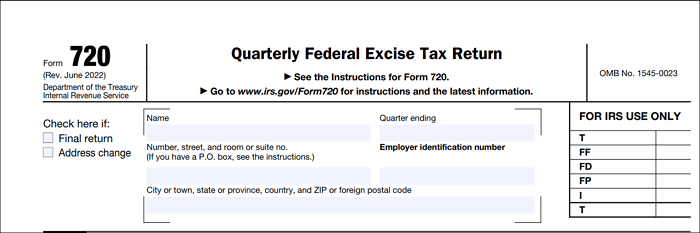

IRS Form 720, also called the Quarterly Federal Excise Tax Return, is a tax form for making federal excise tax payments on specific goods and activities, like fuel, tanning beds, or others. If your business needs to complete the Form 720, you must do it quarterly, and then file electronically or by mail.

How to Fill out A 1099 Form with a Simple Tutorial in 2026

See the newly updated tutorial on how to fill out a 1099 tax form in 2026!

Who Needs to Fill Out and File Form 720

Generally, Form 720 is always used for businesses that owe excise taxes on:

- Gasoline

- Fuel

- Sport fishing equiment

- Water transportation services

- Indoor tanning services

- Coal, gas, guzzlers, vaccines, and tries

- ...

If you got a Form 720, you could find the list of all the goods or services that involve excise taxes items in Part one and Part two. Please make sure that whether alcohol, tobacco, and firearms involve excise taxes, they are not included under IRS Form 720.

Read also: How to fill out w-9 form

How to Fill out Form 8949 [2026 Guide]

Check this tutorial to see how to fill out form 8949 with an example in 2026!

How to Fill Out Form 720 with A Step-by-Step Guide

When it comes to filling out Form 720, it is a little complex and time-consuming. So, we offer you a step-by-step guide to make your task easier.

Step 1. Enter Business Information

In the first part, you need to enter some basic business information, including your name, address, end date of the respective quarter, employer identification number, etc.

Step 2. Fill Out Part I

If your business belongs to one of the following taxes, you need to fill out Part I; otherwise, just skip to Part II:

- Environmental taxes

- Communications and air transportation taxes

- Fuel taxes

- Retail taxes

- Ship passenger tax

- Foreign insurance taxes

- Manufacture taxes

You can find all details in Part I. If your business qualifies, you need to use the respective rate to calculate the taxes your business is responsible for.

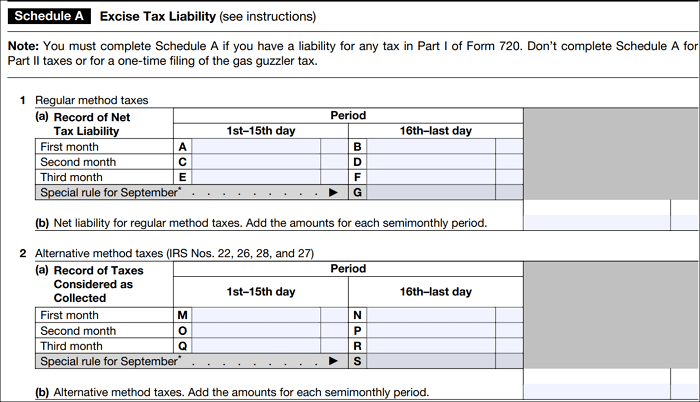

Step 3. Complete Schedule A - Excise Tax Liability

Schedule A reports your business's net tax liability. Here you need to add the net tax liability for each tax for each semimonthly period and each the total in the applicable box.

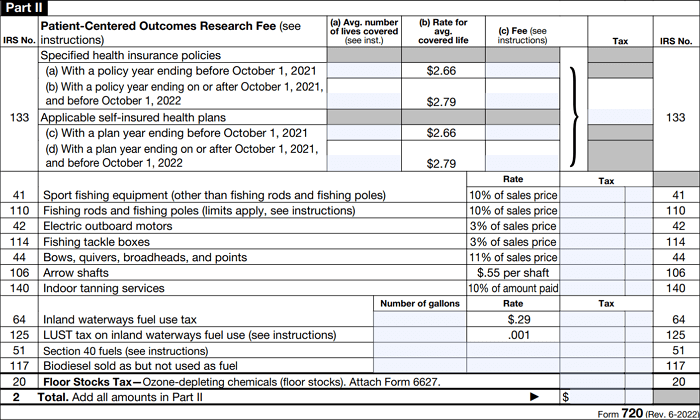

Step 4. Fill Out Part II

You can complete Part II in the same way you did in Part I. If your business belongs to any of the items in the list, then you should calculate your tax using appropriate documents and the rate in the Rate column.

Step 5. Complete Schedule C and Schedule T

If you reported fuel excise taxes in Part one or two, you need to fill out Schedule T and C. When you fill out the form as required, you need to add up your final total on the last Schedule C page and enter it in line 15.

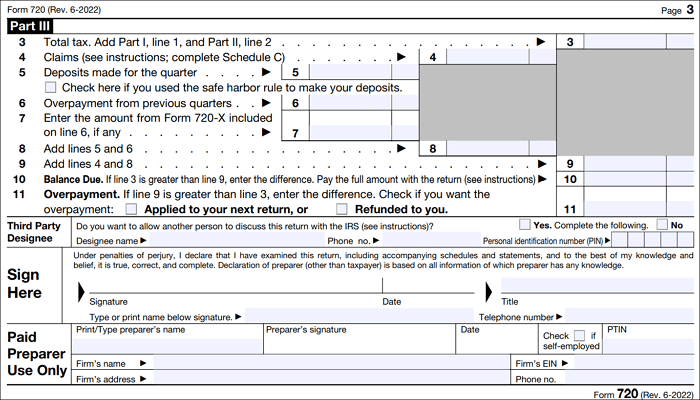

Step 6. Fill Out Form 720 Part III

Part 3 will calculate your total taxes by adding the total from Part 1 and Part 2, and then putting the sum in box number 3. Once all is done, don't forget to sign and date IRS Form 720.

Best PDF Form Filler for Windows - EaseUS PDF Editor

To save time, most of you prefer to fill out and file Form 720 online. At that time, you must need an excellent PDF form filler - EaseUS PDF Editor.

This software performs professionally and perfectly in PDF form managing. With its help, you can flexibly fill out a form, add file text, create checkboxes, or many more in your PDF forms. Plus, it also can act as a PDF editor and converter, which offers a wide range of features like adding/deleting text, adding annotations, managing PDF pages, etc. All in all, it can help you deal with almost all PDF-related tasks effortlessly.

EaseUS PDF Editor

- A versatile PDF program combining editing, viewing, converting, and managing features

- Password protect PDF file from unauthorized viewing and copying

- Manage PDF pages as you want: merging, splitting, reversing, and more

- Convert PDF to or from more than 10 formats

About the Author

Melissa Lee is a sophisticated editor for EaseUS in tech blog writing. She is proficient in writing articles related to screen recording, voice changing, and PDF file editing. She also wrote blogs about data recovery, disk partitioning, and data backup, etc.

![[2025] How to Convert PDF to Google Sheets on Windows/Mac/Online](/images/pdf-editor/en/related-articles/39.jpg)