- About

- Discover EaseUS

- Reviews & Awards

- License Agreement

- Privacy Policy

- Student Discount

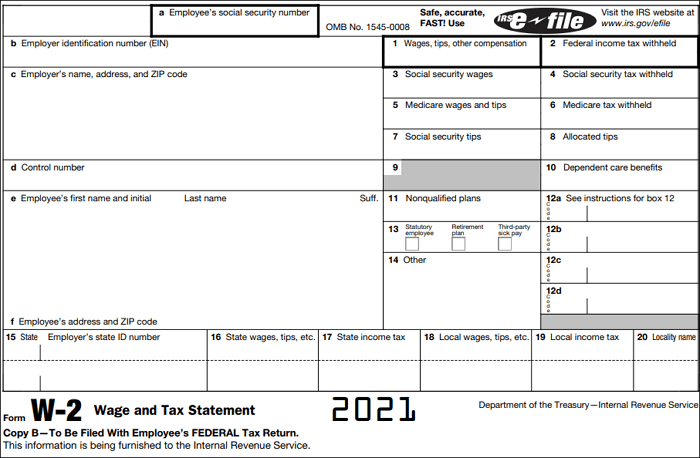

How to Fill Out W-2 Form for Employees in 2026

Melissa Lee updated on Jan 05, 2026 | Home > PDF Knowledge Center | min read

If you an employer, you must be familiar with Form W-2. It is a wage and tax statement that you need to send to your employees and the Internal Revenue Service (IRS) every year. But if you are a new employer or you are not sure whether your employees need the W-2 forms, you can get help from this article. Here we have prepared everything that you may want to know about Form W-2, like

- What is a W-2 form

- How to fill out the W-2 form ★★★

- How many W-2 forms do I need

- Where do I send the completed W-2 forms

So, if you have any questions or concerns about the above-listed items, keep reading this article to cut through the confusion.

You may also want to know how to fill out a W-9 form

What is a W-2 Form

The W-2 form is referred to a wage and tax statement, which shows how much money an employee has earned for the year and the amount of the tax that he or she has already handed over to the IRS. Usually, employees and the Internal Revenue Service will receive this kind of form from the employers by the January 31st deadline.

To put it simply:

- The W-2 form shows your income earned and taxes withheld from the prior year to be reported on your income tax returns

- The IRS uses it to track the individual's tax obligations

4506 T form is a tax return form created by IRS. People use this form when seeking a loan. Here, this post introduces the method on how to fill out a 4506 T form. Follow the guide and fill out your form now!

How to Fill Out a W-2 Form

To fill out a W-2 form on your computer, you always need a PDF form filler. After having testing lots of PDF editors, we want to recommend EaseUS PDF Editor here.

With an intuitive interface and workflow, this Windows PDF editor is easy to use for everyone, even the one without any tech knowledge. Working with this PDF form editor, you can easily handle any PDF form or other PDF documents. Beyond that, it also provides many other functions for you to view, edit, and manage PDF documents with ease. For example, for some important PDF forms such as the W-9 form, W-2 form, and so on, you can password protect PDF files with this versatile PDF software.

Now download this PDF form filler and start to fill out you're W-2 form for your employees.

# 1. Fill Out Box A to Box F

Box a - Employee's social security number

Enter the number shown on the employee's social security card. If the employee does not have a card, he can apply for one by completing Form SS-5. Or if the employee has applied for a card, but the number is not received in time for filling, write "Applied For" in the box on paper forms W-2 filed with SSA. If e-filing enter zeros (000-00-0000)

Box b – Employer identification number (EIN)

Enter the EIN assigned to you by the IRS (xx-xxxxxxx). If you don't have an EIN when filing forms W-2, enter "Applied For" in Box B and don't use your SSN.

Box c – Employer's name, address, and ZIP code

Type the full, legal name you used when you registered your corporation or LLC. Then enter the address of your business, including the zip code.

Box d – Control number

Fill it or leave it blank, and that depends on whether your small business uses control numbers or not.

Box e and f – Employee's name and address

Enter the name as shown on your employee's social security card. If the name does not fit in the space allowed on the form, you can show the first and middle name initials and the full last name.

# Fill Out Box 1 to Box 20

Box 1 – Wages, tips, other compensation

Write the total taxable wages, tips, and other compensation that you paid to your employee during the year. Sometimes the wages you write in Box 1 might be higher or lower than other wages on the W-2 form, so it is not a mistake.

Box 2 – Federal income tax withheld

Enter the total federal income tax withheld from the employee's wages for the year. And it includes the 20% excise tax withheld on excess parachute payments.

Box 3 – Social security wages

Show the total wages paid subject to employee social security tax but not including social security tips and allocated tips.

Box 4 – Social security tax withheld

Show the total employee social security tax withheld, including the social security tax on tips. And for 2026, the amount should not exceed $8,853.60.

Box 5 – Medicare wages and tips

Enter the total Medicare wages and tips in this box. Ensure to enter the tips that the employee reported even if you did not have enough employee funds to collect the Medicare tax for those tips.

Box 7 – Social security tips

Show the tips that the employee reported to you. Make sure that the total of boxes 3 and 7 should not be more than $142,800(the maximum social security wage base for 2026)

Box 8 – Allocated tips

Allocated tips are amounts that you designate to tipped employees, and report the tips in Box 8. Be sure that not all employers have to allocate tips to the employees.

Box 10 – Dependent care benefits

Show the total dependent care benefits under a dependent care assistance program paid or incurred by you for your employees.

Box 11 – Nonqualified plans

Report distributions to an employee from a nonqualified plan or nongovernmental section 457 (b) plan in box 11. And you also need to report these distributions in box 1.

Box 12 – Codes

There are many codes that you need to write in an employee's form W-2. Just complete and code the box for all items.

Note: On Copy A, do not enter more than four items in Box 12.

Box 13 – Checkboxes

There are three boxes: Statutory employee, Retirement plan, and Third-party sick pay. Check any of the three boxes that are relevant to the employee.

Box 14 – Other

You can use this box for any other information that you want to give to your employee.

Box 15 through 20 – State and local income tax information

Use these boxes to report state and local income tax information.

How Many W-2 Forms Do Employers Need

Generally, an employer needs to prepare 6 copies for each W-2 form. The employees will get three copies to file these W-2 forms with their tax returns, and the government will receive two copies for checking. At last, the employer also needs to keep one with the records for 4 years.

Where Do Employers Send the Completed W-2 Form

As mentioned before, you need to complete six copies, and they will go:

- Send Copy A to the SSA

- Send Copy 1 to the state, city, or local tax department

- Send the Copy B, Copy C, and Copy 2 to the employees

- For the Copy D and the copy of Form W-3 with your records for 4 years

The Bottom Line

The W-2 form is important for both employers and employees. If you are an employer who needs to fill out the W-2 form, you can benefit from this post. Additionally, to help you fill the form better, you can try PDF editing programs like EaseUS PDF Editor to make the task easier and easier!

About the Author

Melissa Lee is a sophisticated editor for EaseUS in tech blog writing. She is proficient in writing articles related to screen recording, voice changing, and PDF file editing. She also wrote blogs about data recovery, disk partitioning, and data backup, etc.

![[Fixed] How to Save Outlook Email as PDF in 3 Simple Ways](/images/pdf-editor/en/related-articles/20.jpg)