- About

- Discover EaseUS

- Reviews & Awards

- License Agreement

- Privacy Policy

- Student Discount

[Form 941 Instruction for 2026] How to Fill Out Form 941

Jane Zhou updated on Jan 05, 2026 | Home > PDF Knowledge Center | min read

If you own a small business and have some employees working for you, you may need to fill out and file the IRS 941 form, Employer's Quarterly Federal Tax Return, in each quarter. The 941 form is mainly used to report the federal withholdings from most types of employees. It allows you to detail all the withholding amounts in income taxes, Medicare, Social Security, etc.

However, as an employer, you may need to deal with a ton of tax forms, except for the 941 forms, and you might mix them up easily. So, to avoid major errors while filling, just check the below Form 941 instruction now. Here you will learn what the 941 form is, when and how to fill it out, and much more about IRS 941 form!

All You Need to Know About IRS Form 941

If you are new to dealing with the 941 tax form, you'd better learn the following information before completing this form.

#1. What is the IRS Form 941?

Form 941, also called the Employer's Quarterly Tax Form, is an important payroll-related tax return used by employers to report they have withheld from employee compensation during the quarter. It is also used to calculate and report the employer's Social Security and Medicare tax. It has been used to report other items like the coronavirus pandemic tax credits in recent years.

As an employer, you need to fill out and file the 941 forms four times a year. If you don't file the IRS 941 Form on time, you may get a penalty from the IRS.

#2. When to Fill Out and File 941 Tax Form?

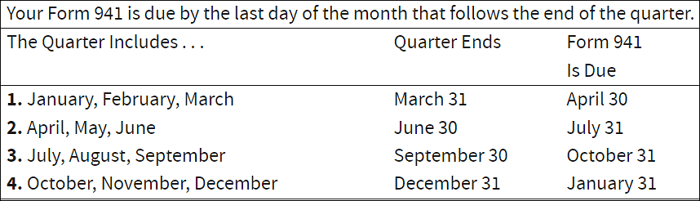

IRS Form 941 is a tax report due every quarter, as we talked about before. So you need to fill out and file the 941 forms in each quarter. It is usually due by the last day of the month following the end of the quarter. If the due date for filing a return fall on a legal holiday, you can file it on the next business day.

How to Fill out A 1099 Form with a Simple Tutorial in 2026

See the newly updated tutorial on how to fill out a 1099 tax form in 2026!

#3. Where Do You File Form 941?

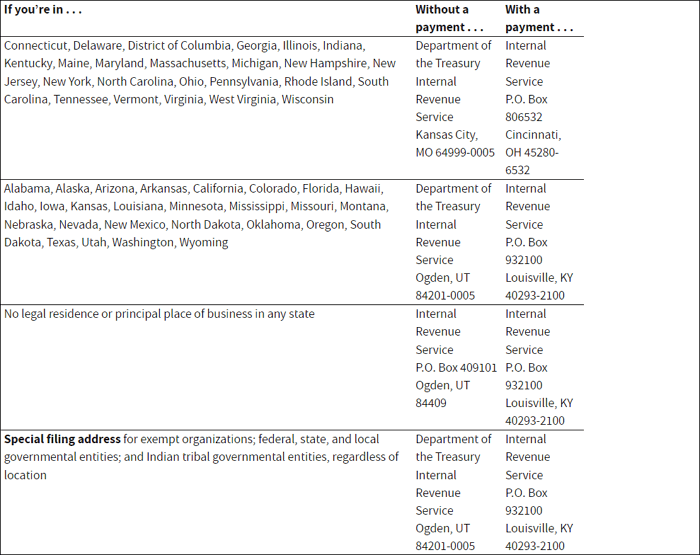

Once you have correctly filled out the 941 forms, you must file them on time. Very often, people will file the 941 form through the federal e-File system, and that is the fastest way ever used. But if you like, you also can mail it. If you take this method, you need to make sure the mail address is right; that depends on your business's state. Most importantly, the payment voucher should be attached.

How to Fill out A 1099-NEC [Latest Guide]

Learn how to fill out a 1099-NEC form with the latest guide!

How to Fill out Form 941 [Step-by-step Guide]

As far as you know, almost all tax forms are in PDF format, as they will always maintain the original layout, no matter what device you use. So, before filling 941 tax form, you need to find an easy yet powerful PDF program, like EaseUS PDF Editor.

This versatile PDF program offers lots of tools to assist you in completing any form or document in PDF format. In terms of the Forms functions, this PDF program lets you add text or other information in the form flexibly. With its help, you can also enjoy the features of creating a Push button, check box, list box, or even importing and exporting data from your existing form with no hassle.

Last but not least, it acts professionally as a Windows PDF editor, making it super easy to add bookmarks to PDF, highlight, crop, convert PDF files, and many more! So just click the below button to get the excellent PDF form filler, then check the tutorial to complete your 941 tax form.

Step 1. Prepare a PDF form filler and the IRS Form 941.

Download and install a fantastic PDF form filler. Next, get the IRS Form 941 from the official website.

Step 2. Type your business information

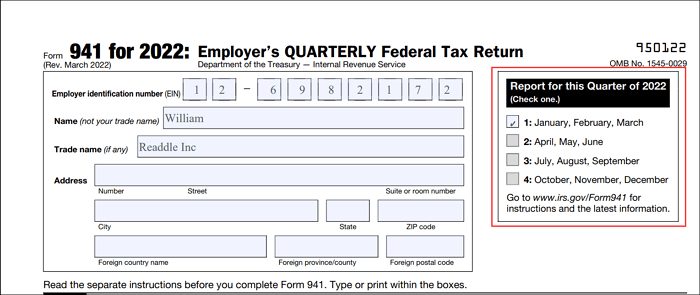

Open the 941 forms with EaseUS PDF Editor. Then you need to fill out your business information. Enter your EN, name, and address in the spaces provided. Besides, you also need to type your mane and EIN on the top of Page 2 and 3. Don't forget to choose the quarter of 2026 you are filling for.

Step 3. Fill out Part 1 in the 941 Form

Part 1 contains 15 lines you need to fill, including the number of employees, the compensation you paid, federal income taxes withheld, social security and medicare tax, etc. So you need to enter all the information one by one.

Step 4. Deposit schedule and tax liability for this quarter.

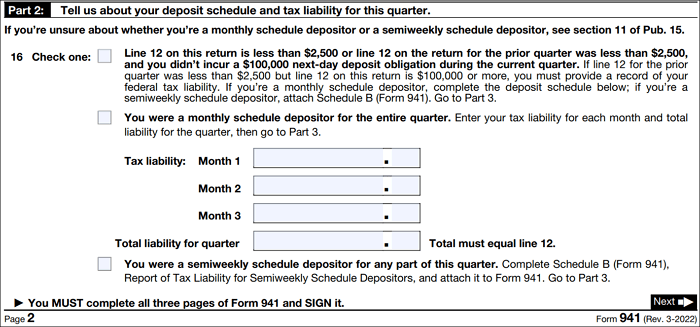

Part 2 is about your deposit schedule and tax liability for this quarter. So here, you need to indicate whether you are a monthly or semiweekly depositor.

- For monthly depositors, just enter the tax liability for each month of the quarter. the total liability must be equal to line 12

- For semiweekly depositors, you need to mark an "X" next to the third box, complete Schedule B, Report of Tax Liability for Semiweekly Schedule Depositors, and attach it to Form 941

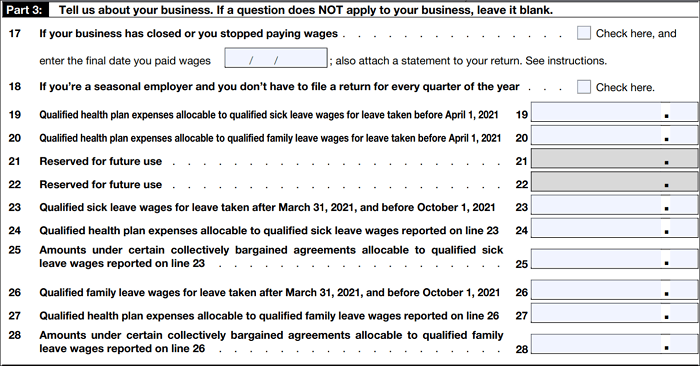

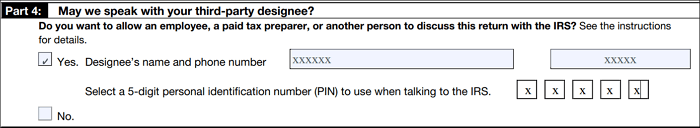

Step 5. Fill out Part 3 and Part 4

You are asked to enter some relevant information about your business in Part 3, such as if the business is closing or a seasonal employer.

And Part 4 requires information about the third-party designee. If you want the third-party designee to discuss your return with the IRS, just check "Yes". If not, select the "No" box.

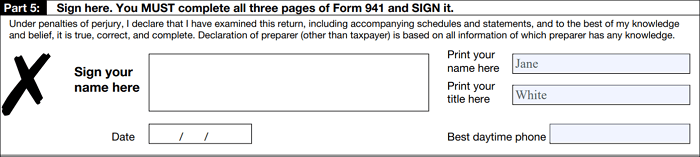

Step 6. Signature

Once you complete each section of Form 941, you need to sign the 941 form in Part 5. When everything goes well, you can file the IRS Form 941 in your desired way.

Here on this page, we offer you an unlimited guide about filling and filing IRS Form 941 to help you avoid some errors. Now just share it with your friends to fill out the 941 Form.

More information about fill tax forms:

About the Author

Jane is an experienced editor for EaseUS focused on tech blog writing. Familiar with all kinds of video/PDF editing and screen recording software on the market, she specializes in composing posts about recording and editing videos. All the topics she chooses are aimed at providing more instructive information to users.

![[2026] Best 3 Solutions to Convert PDF to URL Online Free](/images/pdf-editor/en/related-articles/13.jpg)

![How to Password Protect a PDF in Adobe Reader [Best Choices for You]](/images/pdf-editor/en/related-articles/35.jpg)