- About

- Discover EaseUS

- Reviews & Awards

- License Agreement

- Privacy Policy

- Student Discount

[Full Guide] How to Fill in IRS Form SS-4 PDF Easily

Gemma updated on Jan 05, 2026 | Home > PDF Knowledge Center | min read

Do you want to get an Employer Identification Number (EIN) from the IRS? You should know that the EIN number is assigned for business activities like tax filling or reporting. It likes the social security number for a corporation. An example of an EIN number is 11-1111111. You will have nine digits and there is a hyphen between the second and the third digit.

The IRS form SS-4 is essential as it is your business's unique number. On the day your business is created, you need an Employer Identification Number (EIN) for tax purposes. Also, if you want to create another type of legal entity for the business, the EIN number is needed by IRS. The corporation's bank account and other departments will need this number.

- Part 1. Things You Need to Know Before Filling Out Form SS-4 PDF

- Part 2. How to Fill Out SS-4 PDF Form

- Part 3. FAQs About How to Fill out Form SS-4 PDF

Things You Need to Know Before Filling Out Form SS-4 PDF

Before getting your EIN, know more information about this IRS form SS-4 by following the below guide. This post is dedicated to providing with you a useful guide and overview of the tax form filling purpose.

- Disclaimer:

- This post does not constitute professional tax rules or legal advice. For advanced advice about form SS-4, please consult with tax advisers or a certified accountant for tax purposes.

1. What is the purpose of form?

The main function of the SS-4 tax form is to get an Employer Identification Number (EIN) from IRS. Each business needs one EIN as it is an important process for starting your business. It is also a tax ID number for businesses.

Also, if you have formed an LLC or want to create another type of legal entity for the business, the EIN is needed.

2. Where to file or fax SS-4?

The place to file or fax SS-4 could be varied for different reasons. For example, if you have a principal place of business, office, or legal residence located in the 50 states in the U.S or the district of Columbia, you can file the tax form in Internal Revenue Service Attn: EIN Operation Cincinnati, OH 45999. The fax number is 855-641-6935.

Or if you have no legal residence or principal office in any state or the District of Columbia, please file the tax form to Internal Revenue Service Attn: EIN International Operation Cincinnati, OH 45999. The fax number is 855-215-1627 in U.S.

3. How to apply for an EIN?

As individual taxpayers have social security numbers (SSNs), businesses have their unique numbers for EIN. For that, EIN identifies your business to IRS and lets operate the business legally in terms of tax purposes.

4. Who needs this form?

There are types of entities that can apply the Employer Identification Number (EIN), including employers, estates, trusts, government agencies, non-profit organizations, and certain individuals such as sole proprietors and other entities.

How to Fill out A 1099 Form with a Simple Tutorial in 2026

See the newly updated tutorial on how to fill out a 1099 tax form in 2026!

How to Fill Out SS-4 PDF Form using PDF Editor

After reviewing the guide for form SS-4 PDF, you can follow the below steps to fill out it.

Basically, you need three steps to file out form SS-4.

1. You need to apply for tax form SS-4 online using IRS.gov.

2. Ensure that you apply it by mail or fax it to IRS.

3. Able to connect it with tax pro at H&R Block.

Once you are preparing to fill out the SS-4 PDF form, you need to use the tax form filler to modify the PDF form.

EaseUS PDF Editor is a functional and practical PDF editing software on Windows. You can use it to fill out forms, create forms, and manage form data with ease. Besides modifying the forms, you can also use this software to edit the text, images, etc. Now, download this PDF editor on Windows PC without registration!

[2026] Who can File Tax Form 1040-SR & How to Fill it

Learn about who can file tax form 1040-SR & how to fill it in 2026!

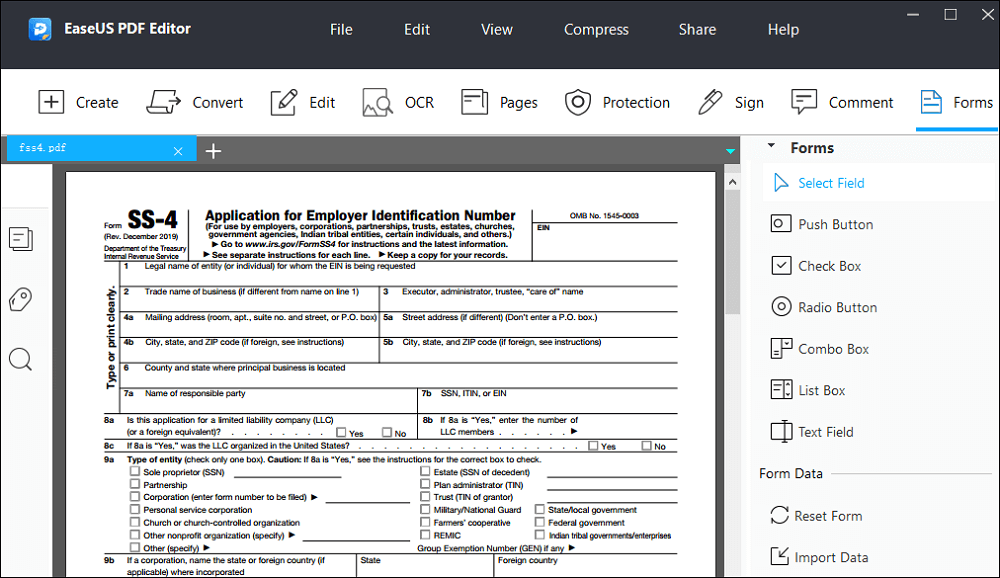

Here is a list of steps for filling out the SS-4 PDF form via PDF editing software, EaseUS PDF Editor. Before filling, remember to install the PDF editor on Windows PC. Then, follow the guide in detail.

Go to the website https://www.irs.gov/pub/irs-pdf/fss4.pdf and download PDF from it. Save it on the desktop, and drag the PDF page into EaseUS PDF Editor. Now, click "Forms" from the top toolbar. Use your mouse to click the SS-4 form in PDF.

Step 1. Fill Out Basic Information

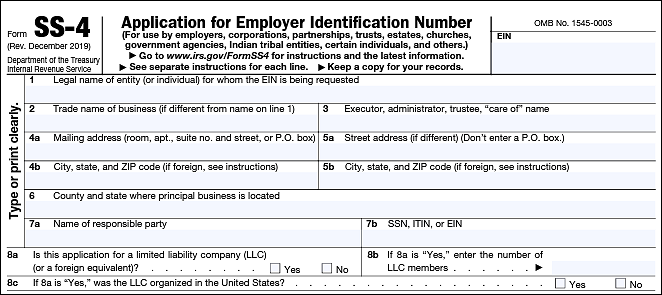

From line 1 to line 8b, you need to fill out the legal name of the entity, the trade name of the business, mailing address, location for city code principal business, the name of the responsible party, etc.

Make sure you put the official business name correctly, otherwise, other people won't recognize the name.

Step 2. Complete Information for Business

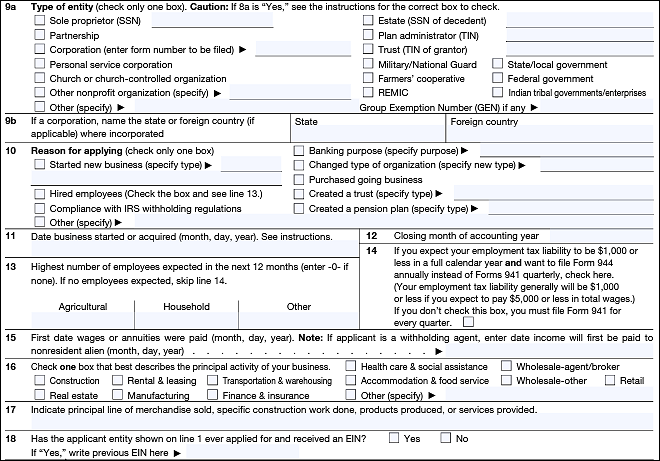

From line 9a to line 18, you need to fill out types of entities such as sole proprietor (SSN), partnership, corporation, personal service corporation, church or church-controlled organization, etc.

In line 10, you need to choose the target reason that you want to apply for the SS-4 form. In line 11, the date the business started or was acquired. From line 15 to line 19, you need to fill out more information about your business.

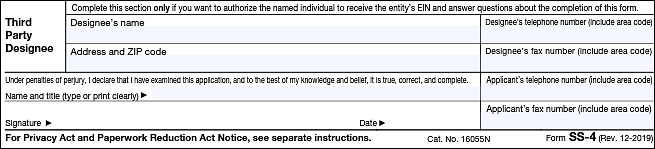

Step 3. Sign Name of Third Party

As this form mentioned, you only need to complete this part only if you want to authorize the named individual to get the entity's EIN and answer the questions below. You need to fill out the designee's name, telephone number, fax number, etc.

Sign your name digitally and also record the date for the SS-4 tax form.

Conclusion

Now, you know how to fill out form SS-4 after following the above part. The main function of this form is to get the Employer Identification Number (EIN). At the time when you are looking for this guide, remember to download this PDF form filler.

FAQs About How to Fill out Form SS-4 PDF

To know more information about filling out the SS-4 tax form, follow the below part. For more official knowledge, you can go for advice from certified accountant. Now, continue reading and grad more useful tips.

1. How do I get an IRS form SS-4?

You can go to website "https://www.irs.gov/pub/irs-pdf/fss4.pdf" for getting SS-4 from IRS.

2. Can I file form SS-4 online?

Yes, and you can look for information from the website "https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online". It's easy to apply for an Employer Identification Number (EIN) online.

3. Why do you need EIN for business?

EIN is regarded as the tax ID number for businesses. For each business, you need this number. Like people having the ID number, businesses need this EIN. To getting this number, you need to fill out SS-4 form and give it to IRS department.

About the Author

Gemma is member of EaseUS team and has been committed to creating valuable content in fields about file recovery, partition management, and data backup etc. for many years. She loves to help users solve various types of computer related issues.

![[Free] How to Open PDF in Word Easily in 2025](/images/pdf-editor/en/related-articles/38.jpg)

![How to Fill out Form 8949 [2025 Guide]](/images/pdf-editor/en/related-articles/34.jpg)

![How to Add Pages to a PDF in Adobe Reader [Updated 2025]](/images/pdf-editor/en/related-articles/24.jpg)