- About

- Discover EaseUS

- Reviews & Awards

- License Agreement

- Privacy Policy

- Student Discount

How to Fill Out Form 3911 for Lost Stimulus Check

Melissa Lee updated on Jan 05, 2026 | Home > PDF Knowledge Center | min read

Sometimes, tax refunds don't always arrive when you expect them to, and the reasons will vary: the tax refund might get lost in the mail, an error may occur in the mailing system, or something else may happen during that time. So, if you don't get the check when it is due, how to solve this problem?

The easiest way is to use the IRS Form 3911, which is used by a taxpayer who filed an income tax return but never received their refund or lost the refund check that was issued to them. However, if you are new to Form 3911, you'd better read some instructions before completing it. To save your time, we provide almost everything you might want to know about Form 3911, so continue reading to learn more tips.

- What Is Form 3911

- When to Use Form 3911

- How to Fill Out Form 3911 with Step-by-Step Guide

- Where to Mail Form 3911

- FAQs About IRS Form 3911

What Is Form 3911

Entitled "Taxpayer Statement Regarding Refund", the IRS Form 3911, is distributed by the United States Internal Revenue Service and is mainly used to help the taxpayers find the missed payments. This form also helps the taxpayers understand why they did not receive refunds as expected.

To complete the IRS Form 3911, you need to know the amount of your tax return, as well as the date you filed the taxes. Moreover, you are required to include the information you can on the tax return, like account numbers, the bank's name, etc. And all of that will help the IRS verify you did not receive the tax return.

When to Use Form 3911

Like we said before, you can use Form 3911 if you did not receive your tax refunds or in other situations like the below:

- Damage or lose the paycheck

- Your paycheck may have been stolen

- You did not receive the check after a long time since filing the tax return

- ...

How to Fill out A 1099 Form with a Simple Tutorial in 2026

See the newly updated tutorial on how to fill out a 1099 tax form in 2026!

How to Fill Out Form 3911 with Step-by-Step Guide

Now, you can start filling out the IRS Form 3911 after having a general idea about it. To complete the task more efficiently, we will share with you an excellent PDF form filler first, and that is called EaseUS PDF Editor.

This PDF editing software makes it easy to create and fill out PDF forms. For creating a PDF form, you just need to go to the "Form" tab, then select the options you want to add on the right toolbar, including the text field, push-button, check box, radio button, combo box, list box, or even directly import data from your existing documents with a simple click. As for filling out the current Form 3911, it is just a piece of cake. Import the PDF document in this program, and enter the information. That it!

Apart from being a PDF form filler, it also performs professionally in the following aspects:

- Offer a set of tools to help you edit and enhance your PDF files: add pictures, bookmarks, background, watermarks, passwords, etc.

- Let you manage your PDF pages flexibly: split, rotate, cut, merge, and extract pages as you want

- Sign PDF documents electrically: add your digital signatures to the PDF contracts in seconds

- Convert to or from PDFs without losing quality: let you convert PDF to JPG, PNG, Word, Excel, HTML, and over ten formats

So, whether you want to fill out or edit PDFs, you can always rely on this versatile PDF software.

When you get an excellent PDF form filler, you can use it to complete the IRS Form 3911 by checking the following tutorial:

Step 1. Download the IRS Form 3911

First, you need to download the IRS Form 3911 from the Internal Revenue Service. The IRS will usually fill out the top part of the form. So here, you have to read and check the top part, including the date of the refund inquiry, the federal tax return, the refund check number, etc. If the information is correct, you can continue step 2.

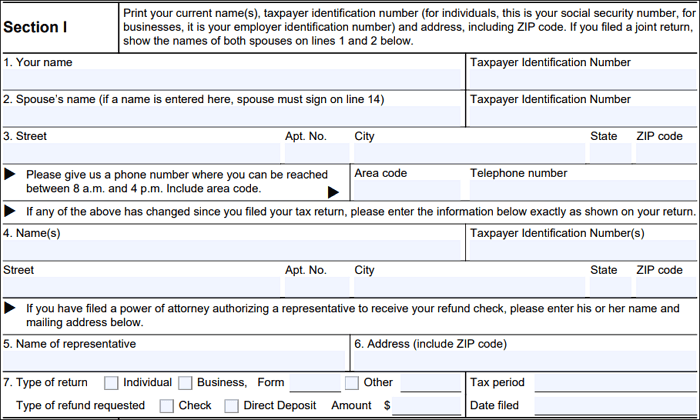

Step 2. Complete Section I

In part 1, you need to enter the basic information: Name, TIN, spouse's name and TIN, address, phone number, changed personal information, name of the representative, type of return, and a refund requested.

Keep in mind that if you indicated a trusted person to receive your check, you need to enter their details.

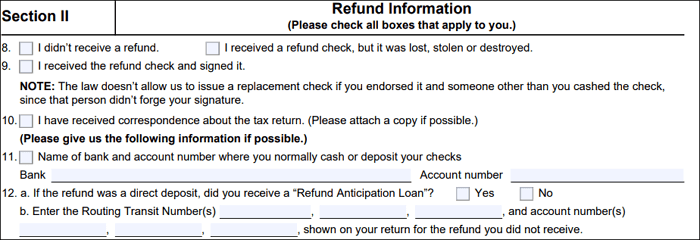

Step 2. Complete Section 2 - Refund Information

Here, you need to enter the information about the refund; for example, select the refund status (don't receive, lost, stolen, destroyed, etc.). While filling out this part, pay more attention to checking the boxes that apply to your situation and provide information regarding the bank where you usually cash the check.

Note: If your check was returned by mail, just ignore this section.

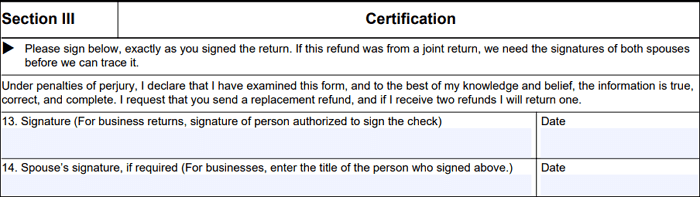

Step 3. Fill out Section 3 - Certification

It is simple to complete section 3, and all you have to do is to date and sign the document. If you have filed a joint tax return with your spouse, you must sign the form and date in your hand.

Step 4. Section 4 - Description of Check

Actually, you don't need to fill out this part, as it is for the Service. So, here, leave it blank.

Where to Mail Form 3911

Once you complete the IRS Form 3911, you need to mail it to the right place.

Usually, the IRS includes an envelope with the correct return address for the taxpayer to use for sending the completed Form 3911. So if you have a self-addressed envelope, you can send Form 3911 in this envelope to the specified contact address. Or, you can send it to the same place you send your tax return.

The Bottom Line

This page includes almost everything about the IRS Form 3911, including the procedure to fill out it, the address to mail it, the questions related to Form 3911, etc. When filling it out, you can use EaseUS PDF Editor to complete the task. All in all, this is a comprehensive Form 3911 instruction you cannot miss.

FAQs About IRS Form 3911

1. Can I fax Form 3911?

Yes. You can fax Form 3911 to 855-404-9091. If you have already requested a trace by phone, don't mail or fax the IRS Form 3911

2. How can I get my tax refund reissue?

If you lost the refund check, you should initiate a refund trace. You can call at 800-829-1954, and either use the automated system or speak with an agent.

3. How do I raise my refund reissue?

First, you need to go to the income tax department's-e-filing website, and then click "My Account" > "Service Request". Next, select "New Request" in the "Request Type", then click "Refund Reissue" > "Submit".

About the Author

Melissa Lee is a sophisticated editor for EaseUS in tech blog writing. She is proficient in writing articles related to screen recording, voice changing, and PDF file editing. She also wrote blogs about data recovery, disk partitioning, and data backup, etc.

![How to Rotate a Table in Word [Updated in 2025]](/images/pdf-editor/en/related-articles/35.jpg)